European Biogas Association (EBA) released its annual statistical report (EBA Statistical Report 2018) which presented data on the European biogas and biomethane market until 2017 inclusive.

In 2017, biomethane was produced in 15 EU countries: Austria, Great Britain, Hungary, Germany, Denmark, Iceland, Spain, Italy, Luxembourg, the Netherlands, Norway, Finland, France, Switzerland, and Sweden. Three other countries: Belgium, Ireland, Estonia – announced plans to start production of biomethane in 2018.

The total number of biomethane plants in Europe at the end of 2017 amounted to 540 units (see Fig. 1). In total, during 2017, 43 biomethane plants were launched, which is two more than in 2016. Although the absolute record was set in 2015 – 89 new biomethane plants.

Fig. 1 – Development of the number of biomethane plants in Europe in 2011-2017

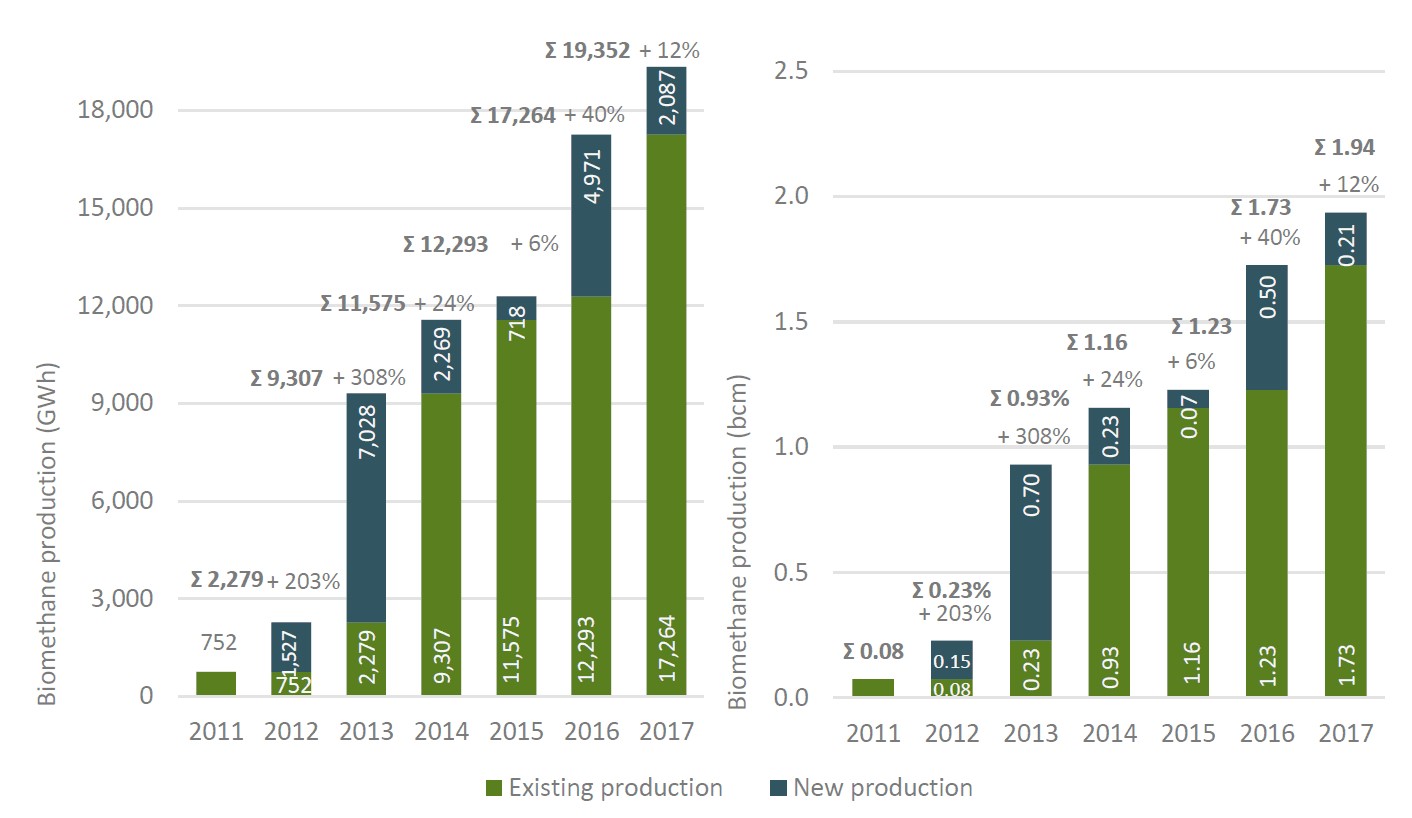

For six years, the amount of biomethane produced per year has increased by 26 times – from 80 million to 1.94 billion cubic meters (see Fig. 2).

Fig. 2 – Development of the number of biomethane plants in Europe in 2011-2017 in GWh (left) and bcm (right)

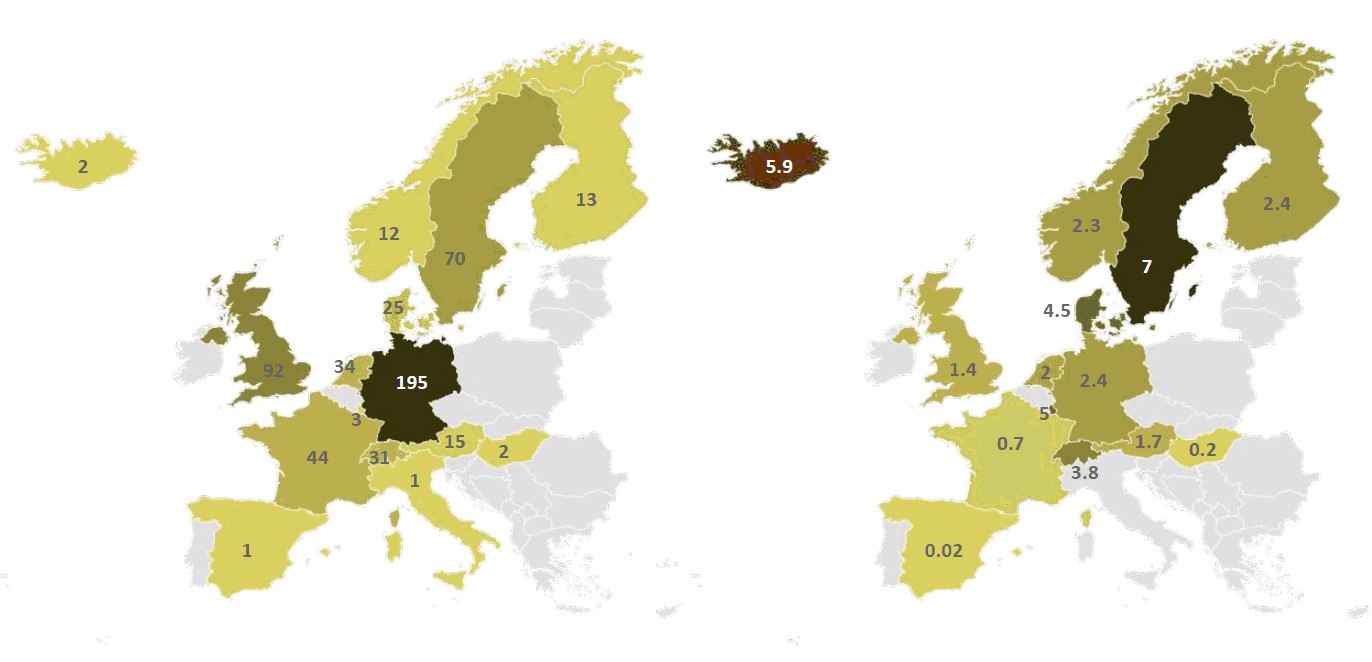

Although the biomethane market did not grow in Germany in 2017, Germany still has by far the highest number of biomethane plants (195), followed by the UK with 92 biomethane plants (see Fig. 3). In terms of the number of plants per million head of population, however, Sweden, Luxembourg, and Iceland come top of the list.

Fig. 3 – The number of biomethane plants in Europe in 2017

A) the total number; B) number of biomethane plants for one million inhabitants

Germany

The leader of the European biomethane market is still Germany, where about half of the European biomethane was produced in 195 plants. The production of biomethane in Germany was stimulated by a fixed fare for electricity produced from biogas and biomethane (0.13-0.24 €/kWh). In 2009, producers received a special surcharge on the tariff for biogas enrichment to the quality of natural gas (0.03 €/kWh). In 2014, the allowance was canceled, but by that time, 175 biomethane plants had already worked in the country. After that, due to the reduction of legislative support, market development in the country has significantly slowed down.

France

The number of biomethane plants in France increased by 18 in 2017, making a total of 44 French biomethane plants. Less than a year later, in the third quarter of 2018, a total of up to 67 biomethane plants was being reported. The country has ambitious plans to build hundreds of biomethane plants by 2020, which will supply biomethane to distribution and gas mains. In the first quarter of 2018, 485 new applications for the implementation of biomethane projects with a total capacity of 8.8 TWh/year were considered. France’s immediate goal is to produce biomethane in the amount of 6 … 8 TWh/year in 2023, which is equivalent to 0.6…0.8 billion m³ of biomethane. The existing in France subsidy scheme pushing towards biomethane production (0.045-0.135 €/kWh), make France the European country with the highest growth rate. The fare in France depends on the capacity of the project and the type of raw materials for the production of biomethane.

France is followed by the Netherlands (+13 plants), Denmark (+8 plants) and the United Kingdom (+7 plants).

Italy

Another potential European leader is Italy, where a variety of methods are encouraged by the state to use compressed and liquefied biomethane as a motor fuel for transport. At the beginning of 2019, 900 applications were submitted in the country for the connection of biomethane to gas networks with a total capacity of 2.2 billion m³/year. It is expected that in 2023 Italy will use 2 billion m³ gas in the transport sector, of which 25% will be supplied with compressed biomethane (bio-CNG).