In January 2024, the International Energy Agency (IEA) published the report “Renewables 2023”, which presented a major analysis of the sector based on current policy and market developments. The IEA report presents a forecast for the deployment of renewable energy technologies in the electricity generation, heat and transport sectors until 2028, and also examines the key challenges of the renewable energy sector and identifies barriers to faster growth. In this report, the IEA for the first time devoted a separate section to biogas and biomethane as the most promising area of bioenergy.

In January 2024, the International Energy Agency (IEA) published the report “Renewables 2023”, which presented a major analysis of the sector based on current policy and market developments. The IEA report presents a forecast for the deployment of renewable energy technologies in the electricity generation, heat and transport sectors until 2028, and also examines the key challenges of the renewable energy sector and identifies barriers to faster growth. In this report, the IEA for the first time devoted a separate section to biogas and biomethane as the most promising area of bioenergy.

The place of bioenergy in the development of RES until 2028

Modern bioenergy is the largest source of renewable energy in the world with a share of 55% and more than 6% of the world’s energy supply. The share of biomass in the electricity generation sector is inferior to solar and wind, but it realizes its potential in those sectors where there are currently almost no other competitive alternatives, namely in the sector of heat and transport fuels.

Biomass: electricity generation

The annual growth of installed electricity capacities from bioenergy over the past 7 years averaged 8.3 GW per year (2016-2022). Solar PV and wind additions are forecast to more than double by 2028 compared with 2022, continuously breaking records over the forecast period to reach almost 710 GW. At the same time, hydropower and bioenergy capacity additions will be lower than during the last five years as development in emerging economies decelerates, especially in China. In China, in particular, bioenergy will no longer have such an increase in electricity in terms of installed capacity compared to other RES, which is due to the reduction of state support, restrictions related to the availability of raw materials and complex logistics.

Bioenergy: heat production

Annual heat consumption worldwide increased by 6% during 2017-2022. Renewable energy – excluding the traditional use of biomass – achieved only half of this increase, and its share of global heat consumption rose by just 2% to 13% in 2022.

More than 2/3 of the global increase in the renewable heat use was in the form of bioenergy (especially in industry) and renewable electricity (mostly in buildings).

In the last 6 years, the industrial use of renewable heat has grown the most in India, mainly due to the expansion of the sugar and ethanol industries using waste biomass and, to a lesser extent, the development of the use of biomass briquettes in industrial boilers.

The next indicator of increase in industrial use of renewable heat was fixed in the European Union, mainly due to wider use of municipal waste and biomass.

In the buildings sector, a significant additional contribution over the past 6 years has also come from the increased use of biomass boilers and stoves in the European Union, although heat pumps have played a major role here.

The traditional use of biomass is still the main component of bioenergy and all renewable sources, but this way of use that must be transformed into modern approaches to bioenergy. Although the expected growth of bioenergy in the next 5 years is much smaller, compared to the use of renewable electricity for heating, but it is the transition from the traditional unsustainable use of biomass for heat to modern technologies. It is the main task of the world bioenergy sector for the heat production in the coming years.

Note 1: Traditional use of biomass for energy production is defined as residential biomass consumption in developing countries and refers to the often unsustainable use of wood, charcoal, agricultural residues and animal manure for cooking and heating (IEA, 2010b, Annex I ).

Note 2: Current estimates indicate that more than 2.5 billion people still rely on traditional biomass use as their primary source of energy.

However, bioenergy remains the largest renewable source of heat in buildings globally by 2028, accounting for one-fifth (1.1 EJ) of the sector’s current renewable heat over the forecast period. Modern bioenergy use in buildings is growing most notably in sub-Saharan Africa (+0.5 EJ), China (+0.3 EJ) and India (+0.2 EJ), where advanced biomass cooking and heating stoves have replace the traditional use of biomass.

Conventional non-sustainable biomass use will decrease by 17% (-4.2 EJ) globally during 2023-2028, mainly due to urbanization trends and policy intervention, driven in part by environmental concerns in China and India. Steady sales of wood chip and wood pellet stoves and boilers in the European Union, especially in Italy, France and Germany, also contribute (+0.07 EJ) to the bioenergy outlook. However, high investment costs for automated systems, rising biomass fuel prices, technical requirements (e.g. fuel storage space) and supply chain complexities prevent faster adoption compared to other RES.

Bioenergy: transport

Biofuel deployment is accelerating and diversifying into renewable diesel and biojet fuel. Emerging economies, led by Brazil, are dominating global biofuel expansion, which is expected to grow 30% faster than in the past 5 years. Due to stringent biofuel policies, growing demand for transportation fuels, and large feedstock potential, emerging economies are projected to contribute 70% to global biofuel demand during the forecast period. Brazil alone accounts for 40% of the expansion of biofuel production by 2028. Political will is a major driver of this growth, as governments step up efforts to secure affordable, safe, and low-emission energy sources. Biofuels used in the road transport sector remain the main source of new supply, accounting for almost 90% of the growth.

Electric vehicles (EVs) and biofuels have proven to be a powerful, complementary combination to reduce oil demand. By 2028, biofuels and renewable electricity used in electric vehicles are projected to offset 4 million barrels of oil equivalent per day, more than 7% of projected oil demand for transportation. Biofuels remain the dominant way to avoid oil demand in the diesel and jet fuel segments. Electric vehicles are outpacing biofuels in the gasoline segment, especially in the United States, Europe and China.

The role of biogas and biomethane

Biogas production has been increasing since the 1990s, but political support has grown significantly in the past two years due to a combination of factors. First, due to energy security issues caused by the Russian invasion of Ukraine and the subsequent energy crisis, biogas is now being considered as a domestic energy source that can reduce dependence on natural gas imports and support energy security in many countries.

Second, given the urgent need to limit global temperature rise to 1.5°C, countries have begun to look at biogas as a ready-to-use technology that can help accelerate decarbonization in the short term. Many countries consider biogas as a key component in their energy transition strategies.

Along with targeted policies, market conditions stimulate the use of biogas. While combined heat and power plants typically run on biogas, other gas demand markets (e.g. gas utilities, industry and transport sectors) will require the use of biomethane, purified biogas with a high methane content similar in quality to natural gas, which means it can replace it. Biomethane is also known as renewable natural gas (RNG) in the United States and Canada, bio-compressed natural gas or compressed biogas (bio-CNG or CBG) in India, and bio-natural gas (BNG) in China.

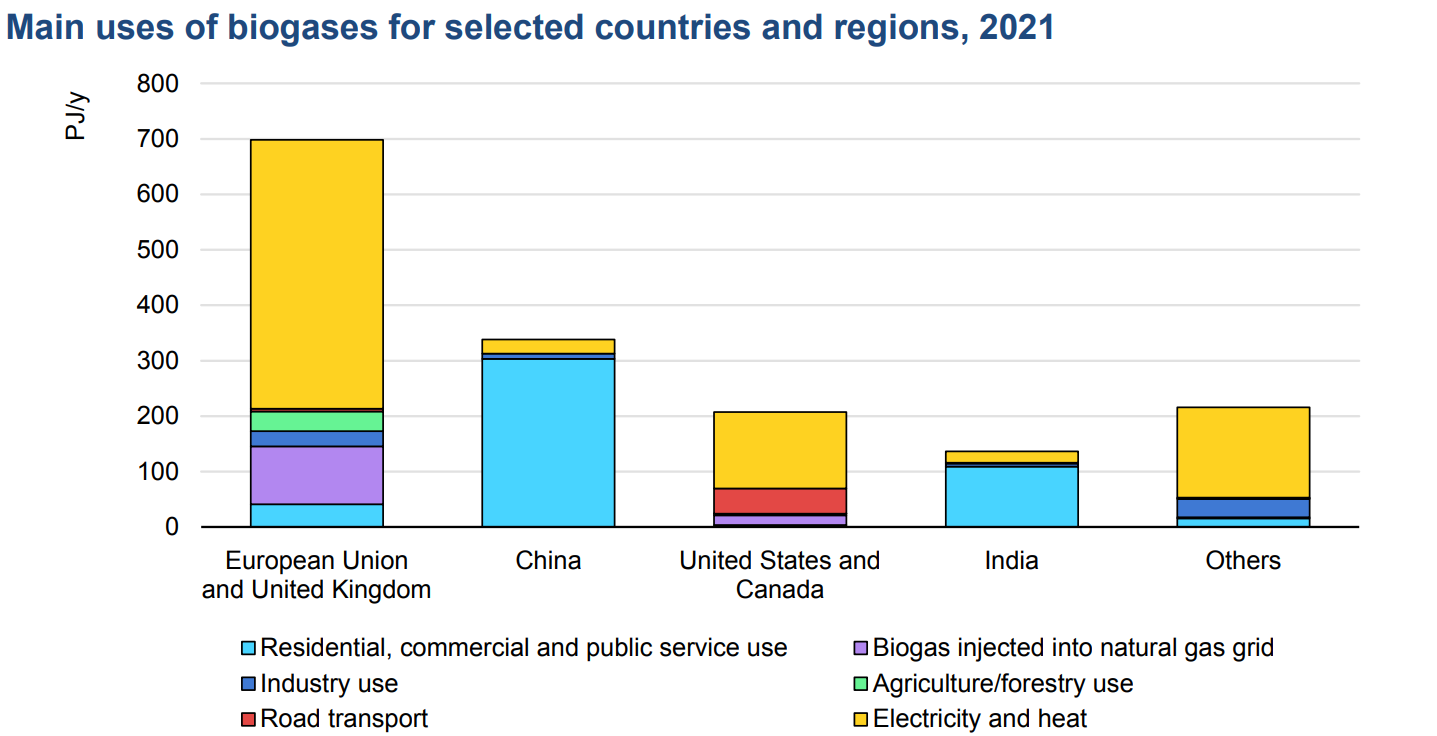

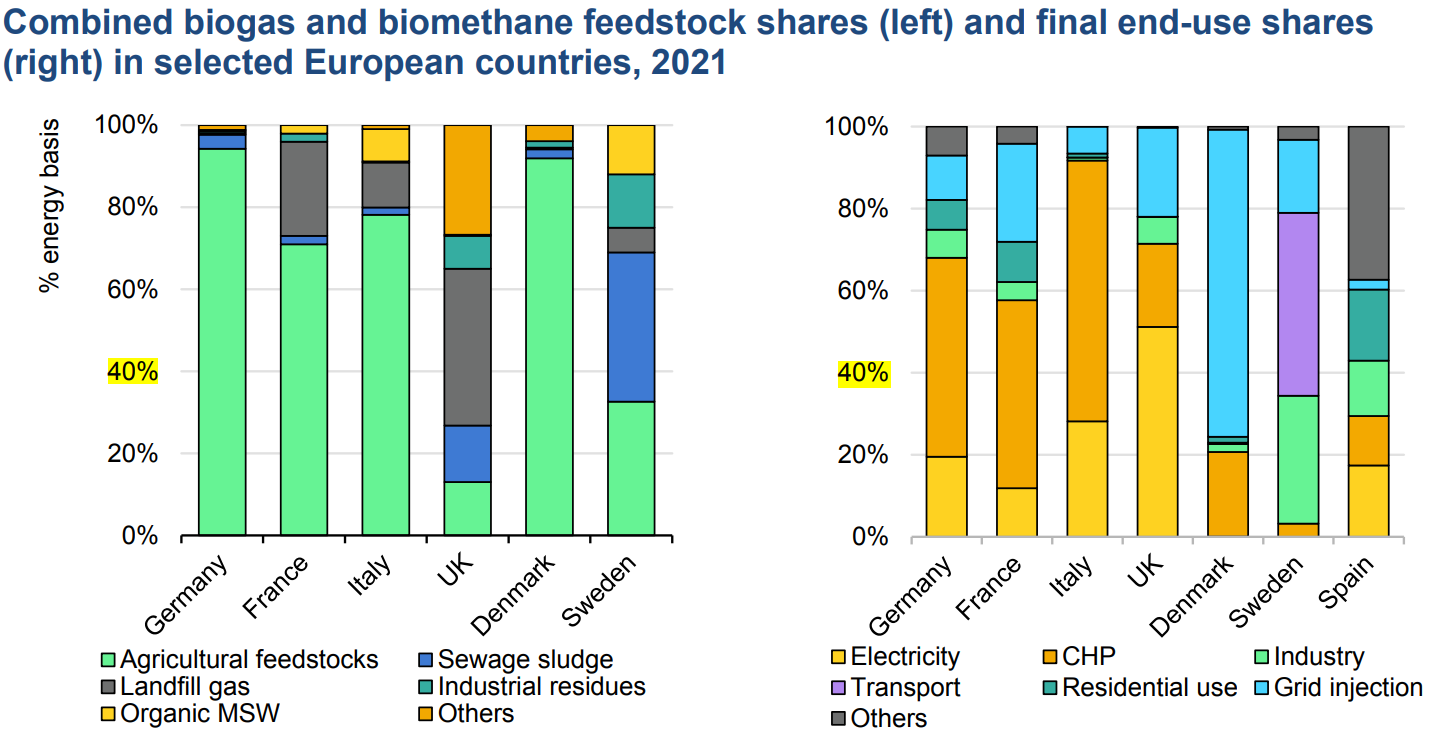

The combined global production of biogas and biomethane will reach over 1.6 EJ in 2022, a 17% increase over 2017. Almost half of production is based in Europe, with Germany alone providing almost 20% of global consumption. Another 21% is produced in China, followed by the USA (12%) and India (9%). However, regional and national differences can be significant. Depending on the characteristics of each energy system, biogas/biomethane development is supported by different governments in different ways to complement the rest of their energy matrix.

Source: Renewables 2023 | IEA report

We thank the expert of the Bioenergy Association of Ukraine Oleksandra Tryboi for the analysis of the document.