The We Build Ukraine Analytical Centre has presented an analytical note titled ‘Strategic Roadmap for Green Biofuels in Ukraine: Market Development and Harmonisation with the EU with a Focus on the Maritime Sector’. The document, developed based on Denmark’s experience, offers an in-depth analysis of global and European regulatory frameworks for decarbonisation of the maritime sector, defines the role of biofuels, and formulates practical recommendations for Ukraine. UABIO experts took an active part in its preparation and discussion.

Key point: Using biofuels, including liquefied biomethane (Bio-LNG), is the most flexible and cost-effective way to cut emissions in maritime transport. Ukraine has a lot of potential to become a top supplier of these green fuels.

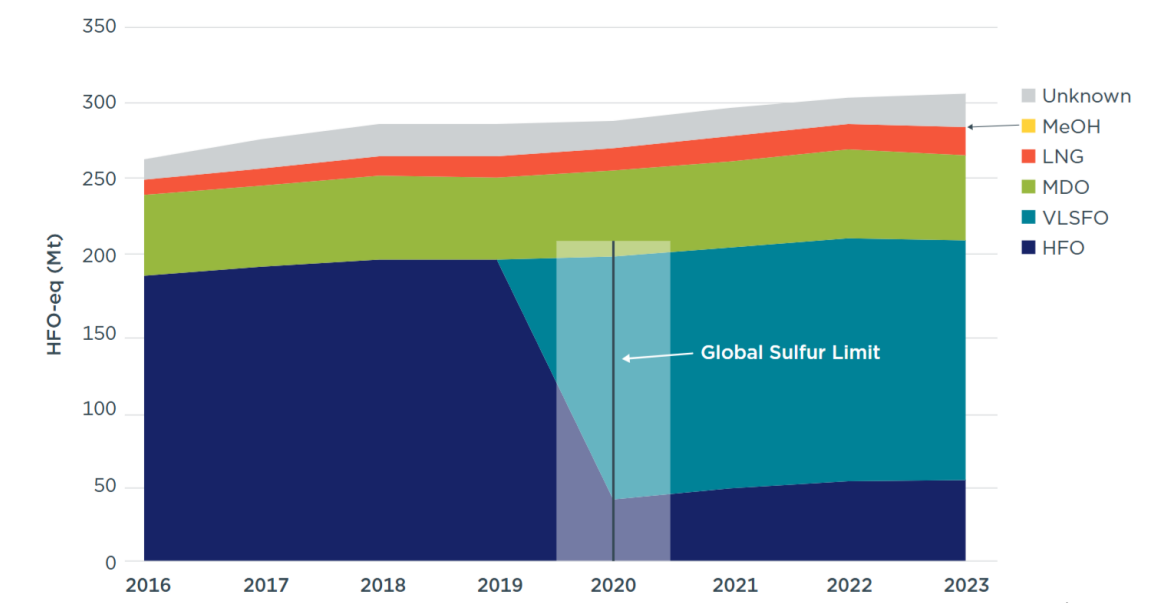

The use of fuels in shipping

In 2023, global shipping consumed approximately 300 million tonnes of heavy fuel oil (HFO) equivalent. Greenhouse gas (GHG) emissions from this sector have increased by 20% over the last decade and account for 3% of global emissions. Without action, they could reach 130% of 2008 levels by 2050.

Very low sulphur fuel oil (VLSFO), approximately 150 million tonnes, is consumed mainly in the sector. In addition, ships consume 56 million tonnes of marine diesel oil (MDO) and over 50 million tonnes of heavy fuel oil (HFO). LNG consumption reached 18 million tonnes in HFO equivalent, and methanol consumption reached 160,000 tonnes.

At the same time, according to estimates by the international certification and classification society DNV, biofuel consumption by ships amounted to approximately 0.7 million tonnes of oil equivalent in 2023, which accounted for only 0.6% of global supplies. DNV estimates Bio-LNG supplies for shipping at approximately 0.1 million tonnes of oil equivalent. Biofuel consumption is growing, and biodiesel bunkering is possible at more than 670 facilities, while Bio-LNG is possible at 106 facilities. A similar trend can be seen in the EU, where traditional marine fuels dominate and LNG consumption accounted for more than 8% of total fuel consumption in 2023.

Fuel consumption in HFO equivalent by the global maritime fleet by fuel type from 2016 to 2023. Source: ICCT.

Regulatory framework for decarbonisation of the maritime sector

At the global level, decarbonisation of the maritime sector is defined by the International Maritime Organisation (IMO) Strategy for reducing greenhouse gas emissions from ships (reducing GHG emissions by 20-30% by 2030 and 70-80% by 2040, and achieving net-zero emissions by or around 2050) and the IMO Net-Zero Framework, a mechanism for financial liabilities for non-compliance with greenhouse gas emission reduction requirements, which has not yet been approved.

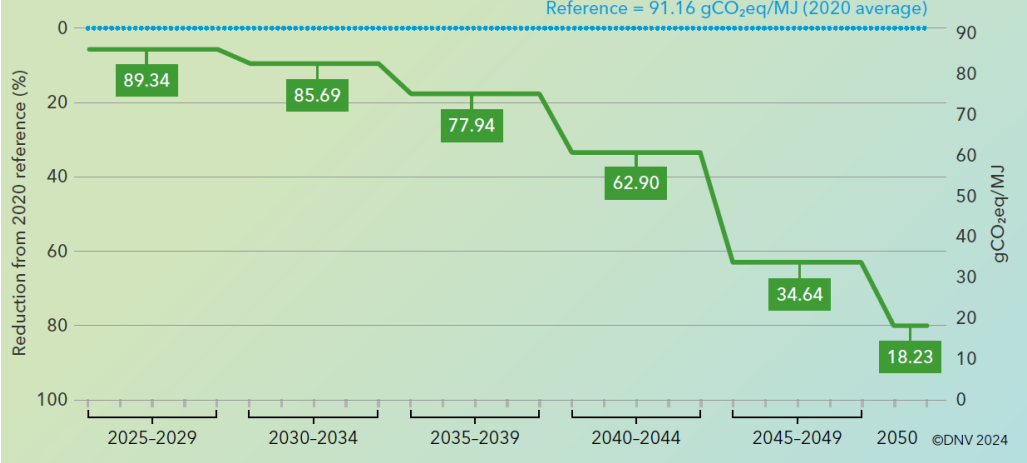

In the EU, the use of renewable and low-carbon fuels in maritime transport is covered by the FuelEU Maritime Regulation (gradual reduction of greenhouse gas emissions from fuels: -2% by 2025 and -80% by 2050).

FuelEU Maritime requirements for GHG emission intensity 2025–2050. Source: DNV.

First-generation biofuels, such as biofuels based on feed and food crops, cannot be used to achieve these objectives. However, advanced biofuels and renewable fuels of non-biological origin that meet the sustainability criteria and greenhouse gas emission reduction requirements set out in the EU REDII/REDIІI Directives can be counted towards the targets. Since 2024, maritime transport has been included in the scope of the EU Emissions Trading System (EU ETS). Currently, these requirements cover ships calling at EU ports with a gross tonnage of more than 5,000 GT, but will eventually be extended to smaller ships.

The role of biofuels in decarbonising shipping

The use of alternative fuels instead of traditional fossil fuels in maritime transport is a key measure for decarbonisation, allowing GHG emissions to be reduced by 100%. To convert ship power plants to alternative fuels such as LNG, methanol and ammonia, complex and costly modernisation of ships and fuel logistics infrastructure is required. Biofuels, on the other hand, are considered ready-to-use fuels in ships with existing engines and infrastructure, which can be used as a supplement or replacement for traditional fuels. At the same time, under certain conditions, some types of biofuels may require minor technical adaptation or modernisation of existing ship equipment.

Overall, new technologies and fuels for decarbonisation increase the cost of maritime transport. It is expected that by 2050, biofuels will account for 11% of the fuel mix in maritime transport.

The most mature technologies currently available for ships are FAME (fatty acid methyl esters) biodiesel and HVO (hydrotreated vegetable oil) renewable diesel fuel for single-fuel ships, which account for the majority of ships in operation and on order. On the other hand, Bio-LNG is used for dual-fuel vessels, of which 1,539 are in operation and 966 are on order. Approximately 0.7 million tonnes of biodiesel are already being supplied to shipping from 20 million tonnes of global production. Bio-LNG supplies about 0.1 million tonnes of biofuel for shipping out of 9 million tonnes of global production.

Locations where biofuel bunkering has taken place since 2015 (green) and locations where biofuel suppliers have declared availability (red); each location represents one port; bunkered biofuels include FAME, HVO, biomethane and biomethanol. Source: DNV.

Given the current fuel price situation, the use of biofuels and biomethane will become more economically attractive in the EU, considering the gradual increase in greenhouse gas emission intensity requirements under the FuelEU Maritime Regulation. In addition, the use of biofuels and biomethane reduces the cost of purchasing emission allowances in the EU ETS system.

According to the analysis of three fuel use strategies (for a vessel with a deadweight tonnage of 80,000 DWT operating between EU countries), the use of biofuels provides significant savings, taking into account the need to purchase EU ETS allowances and FuelEU Maritime penalties. The total costs associated with fuel and GHG emissions over 20 years of operation (2025–2044) at current energy prices for ships running on fossil fuel MGO will amount to €198.07 million, while for ships running on a mixture of MGO and FAME biofuel, it will be €105.65 million, and for ships running on LNG and Bio-LNG, it will be €109.33 million.

Prerequisites for biofuel production in Ukraine and its use in the maritime sector

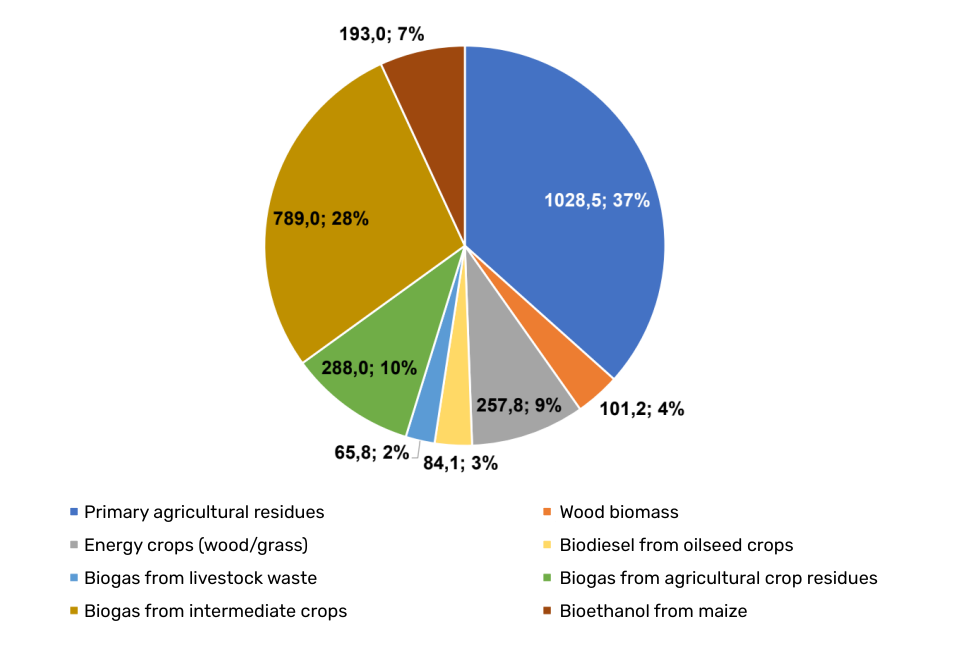

Ukraine has significant biomass potential (approximately 26 million tonnes of dry matter per year in 2021) and other important prerequisites for the successful development of bioenergy. The total annual potential for biomethane production in the agri-industrial sector from waste, by-products and specially grown energy crops is 7.65 million tonnes of fuel equivalent.

The war has reduced biomass resources in Ukraine due to the destruction of the ecological system and contamination of territories, in particular with explosive objects. Given the environmental consequences of the war for Ukraine, it would be advisable to expand the list of raw materials for the production of advanced motor biofuels, in particular to regulate the possibility of growing such raw materials on contaminated, unused, low-yield and degraded land.

Taking into account the impact of military actions and trends in agricultural production in Ukraine, the economic potential of biomass for producing biofuels for water transport can be estimated at an average of 2.9-3.0 million tonnes of fuel equivalent per year. Thus, given the significant areas of degraded land in Ukraine, it is advisable to grow energy crops for further processing into biofuels.

Structure of biomass potential in Ukraine for producing biofuels for water transport (2024). Source: We build Ukraine. Translation: UABIO.

For the needs of international water transport, which aims to replace marine fuels in existing engines, the cultivation of energy oil crops (in particular as intermediate crops) for the production of FAME and HVO is of particular interest. This will significantly reduce current greenhouse gas emissions. In addition, Ukraine already has a production facility for liquefied biomethane Bio-LNG, which can be used to refuel ships. With the development and commercialisation of technologies, biomass-to-liquid (BtL) fuels and bioethanol, in particular those obtained from lignocellulosic raw materials, will become promising for the maritime sector.

The role of biomethane

Biomethane is the most promising domestic fuel for production and use in the maritime sector. Its key advantages include:

- the possibility of production from a wide range of raw materials classified as waste in Annex IX of the EU RED II/III Directive. These include straw, stalks, intermediate and cover crops, manure, slurry, microalgae;

- the greatest possible reduction in greenhouse gas emissions during use. Biomethane often has negative carbon intensity (the only one among all biofuels and e-fuels);

- can be used directly (as Bio-LNG) on ships adapted for LNG consumption;

- can be transported cheaply to EU countries via pipelines, in particular to Denmark, where it can be used to produce Bio-LNG or biomethanol.

Conclusions

There are a number of systemic and interrelated barriers on the path to large-scale production and export of biofuels and biomethane for the maritime sector. These barriers cover economic, raw material, logistical, regulatory and technical areas. Effective implementation of the roadmap for green biofuels and the transformation of maritime transport in Ukraine requires the creation of a modern and favourable regulatory framework. To stimulate demand and supply in the biofuel market, the state can use a number of proven tools that will create a level playing field for competition between traditional and new types of fuel. The roadmap contains short- and medium-term measures for the development of biofuels for the maritime sector in Ukraine.

Download the full text of the analytical note (in Ukrainian)

This review for SAF Ukraine was prepared by Semen Drahniev, an expert at the Bioenergy Association of Ukraine.