Last month, the European Biogas Association (EBA) published a statistical report for 2023 on the state of biomethane production and use in European countries. Let’s look at the main data from the report.

Production

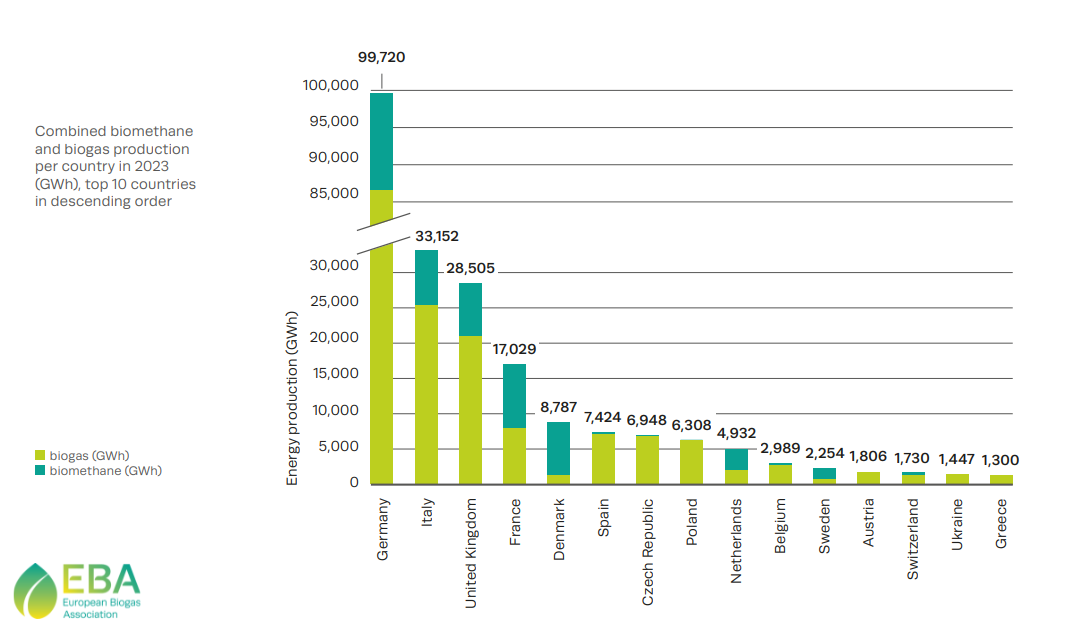

In 2022, primary energy production within the EU was 23,566 PJ or 6,550 TWh, which is 5.9% lower than in 2021. Renewables accounted for the highest share of production (43.2%). Bioenergy represented 59% of total renewable energy production in Europe, which is equivalent to 1,670 TWh Combined biogas and biomethane production in 2023 amounted to 234 TWh or 22 bcm. This is 7% of the natural gas consumption of the European Union in 2023.

Biomethane production grew to 52 TWh or 4.9 bcm in 2023 with an installed capacity of 6.4 bcm/year by the first quarter of 2024. Countries with the strongest growth in their biomethane production in 2023 were Italy, France, Denmark, and the United Kingdom.

Source: EBA.

At the end of 2023, Europe had 1,510 biomethane-producing facilities, marking a substantial growth of 201 plants compared to 2022. Further growth in the number of facilities is recorded. In France alone a further 1,232 projects are at various stages of development. There are now biomethane plants in 25 European countries. Portugal joined the biomethane-producing countries in 2022. In 2023, Lithuania and Ukraine started their first plants producing biomethane. An analysis of statistical data shows that biomethane plants (35 GWh/year) are typically almost four times larger than biogas plants (9 GWh/year) producing electricity and heat.

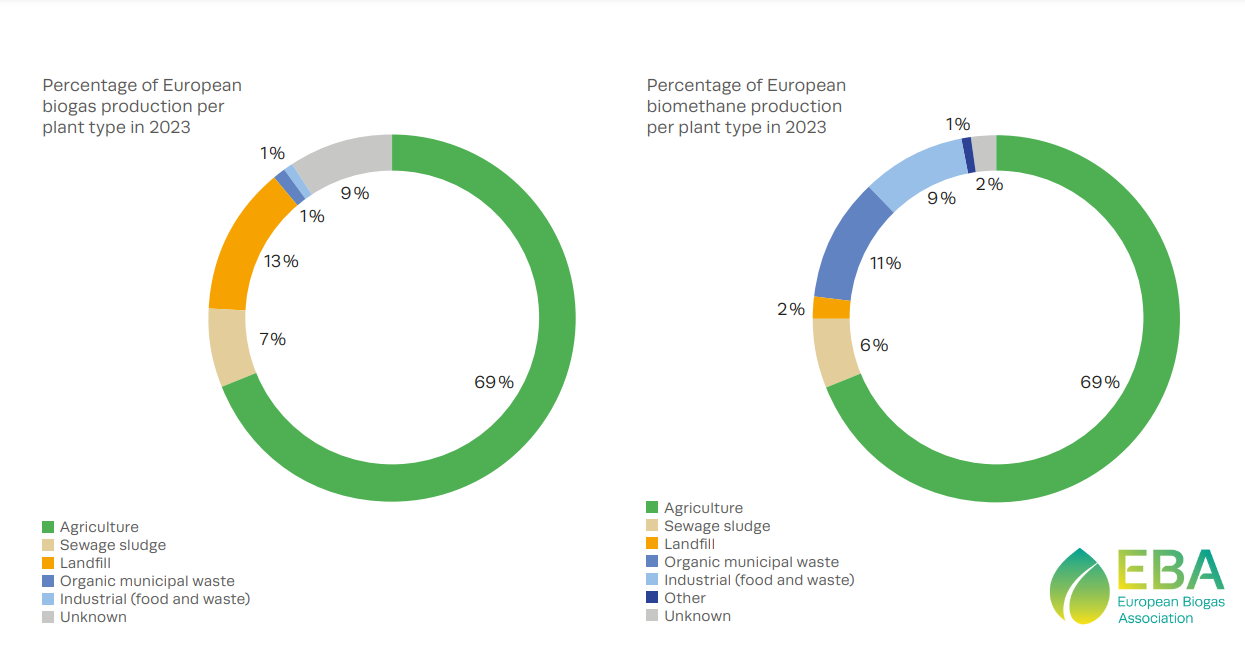

In recent years, there has been a clear trend towards the utilization of feedstock delivering the best GHG savings is visible for biomethane production: agricultural residues, organic municipal solid waste, sewage sludge and industrial waste.

Source: EBA.

At the same time, in 2023, there were 162 solid biomass gasification projects in Europe that could potentially be used for biomethane production. Currently, the majority of gasification plants (85%) use syngas to produce electricity and heat in cogeneration units. Germany is the leader in terms of the number of gasifiers (38%).

In Europe in 2023, there were 25 operational green e-methane production plants, with the largest concentration of plants in Germany (13 plants). Synthetic methane is produced using mainly ‘green’ hydrogen and biogenic carbon dioxide (CO2).

Source: EBA.

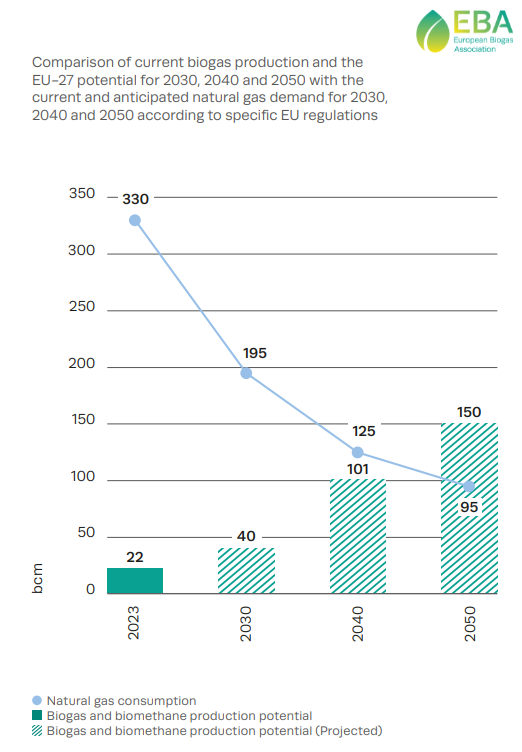

In Europe, 26 countries have developed National Energy and Climate Plans (NECPs) until 2030. Out of the 26 drafts and final updates of the NECP, almost all mention biogas and biomethane. In total, 13 countries have a target for the development of biomethane production. The total for European countries is 14.6 billion m3/year. The growth in biomethane production at the current rate is close to reaching the biomethane volumes set out in the NECP by 2030. However, there is still a gap between the REPowerEU target of 35 billion m3 of biomethane and the available total biogas potential by 2030.

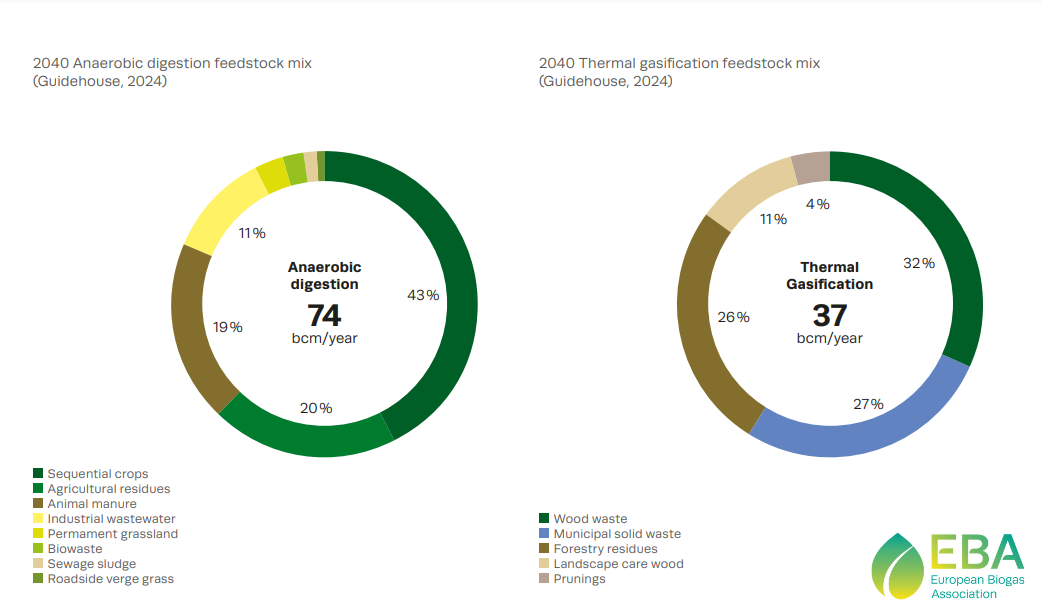

According to the European Biogas Association, Europe could potentially produce 40 billion m3 of biomethane in 2030. In 2040, it will already be 111 bcm biomethane, of which 101 bcm relates to the EU-27. This potential is made up of 74 bcm from anaerobic digestion (67% of the total) and 37 bcm from thermal gasification (33% of the total). Research and innovation is expected to unlock additional biogas potential in ways not yet considered in the above calculations.

Source: EBA.

Currently, €27 billion has already been earmarked for investments in biomethane production in Europe. This is expected to provide a total added capacity of 6.9 billion m3/year of CH4. Thus, additional investments and efforts by all stakeholders are needed to achieve the REPowerEU programme’s target of 35 billion m3 of biomethane in 2030, and even more so to fully realise the declared production potential.

According to the European Commission, the EU’s gas consumption amounted to 330 bcm, of which 290 bcm (pipeline and LNG combined) were imported. Considering this high import rate, and thus high gas dependency on third parties, it is easy to see the strategic importance of investing in biogases

End-uses

In 2023, 23% of upgraded biogas was used for transport, 17% for buildings, 15% for power generation and 13% for industry. This balanced distribution demonstrates how versatile biomethane is as a renewable energy source.

In 2023 the transport sectors’ energy consumption accounted for over 29% of EU’s final energy consumption, with 10% of renewables. Countries such as Italy, Sweden, Finland, and Estonia choose a clear direction of biomethane use for transport, with almost all biomethane being used as a transport fuel.

There were 59 active bio-LNG producing plants in Europe in 2023, and this number is expected to increase sharply in the years 2024-2027, with 134 bio-LNG plants scheduled to be ready by 2027. The projected bio-LNG production capacity by 2027, considering only confirmed plants, adds up to 21.1 TWh per year.

European industries account for 25% of the EU’s final energy consumption. Biomethane use in industries is particularly suitable to replace natural gas as feedstock to produce basic chemicals and materials or for industrial processes, where limited low cost decarbonization options exist.

The total electricity production from biogas and biomethane amounted to 72 TWh, accounting for over 6% of the renewable electricity produced in EU-27

Dispatchable power generation capacity in the EU is declining (from 425 GW in 2012 towards 380 GW in 2022). Biogas/biomethane are essential to bridge periods with prolonged low solar and wind output. Germany only already provides for 2 GW of dedicated flexible capacity

from biogas-CHP’s.

The turnover of the biogases industry in the EU-27 was already €5.8 billion in 2022, €0.3 billion more compared to 2021. With this, biogas and biomethane cover 3% of the turnover of all renewable energy technologies.

Additional economic value

In addition to energy provision, biogases deliver numerous additional environmental, economic, and social benefits. For aerobic digestion (AD), the additional economic value goes up to 175 €/MWh of biogas and for gasification up to 162 €/MWh.

The biogases industry is responsible for more than 250,000 jobs today, of which approximately 70,000 are direct jobs and 170,000 are indirect jobs. The sector can bring a total of 500,000 jobs by 2030, 1.3 million jobs in 2040 and 1.8 million jobs by 2050.

The production of biogas and biomethane reduces greenhouse gas emissions by

- avoidance methane emissions,

- replacement fossil fuels,

- replacement synthetic fertilisers,

- building soil organic carbon,

- enabling the rise of other renewables by delivering energy system integration.

The biogas and biomethane industries can supply an important source of biogenic CO2 feedstock for the sustainable production of for example, e-fuels, sustainable chemical products. In 2023, Europe could have utilised 29 Mt of biogenic CO2, based on the volume of biogas and biomethane produced in that year (22 bcm), this corresponds to 71% of the 2022 CO2 demand in the European Union.

The production of biogas and biomethane is a waste recycling process, meaning the implementation of the principles of the circular economy. Finally, it is a substitute for synthetic fertilisers.

This review for SAF Ukraine was prepared by Yurii Matveev, member of the Expert Council of the Bioenergy Association of Ukraine.