The U.S. Department of Agriculture (USDA) has published the ‘European Union: Biofuels Annual’ report, which outlines the state of production and consumption of biofuels for transport in the EU.

Report Highlights:

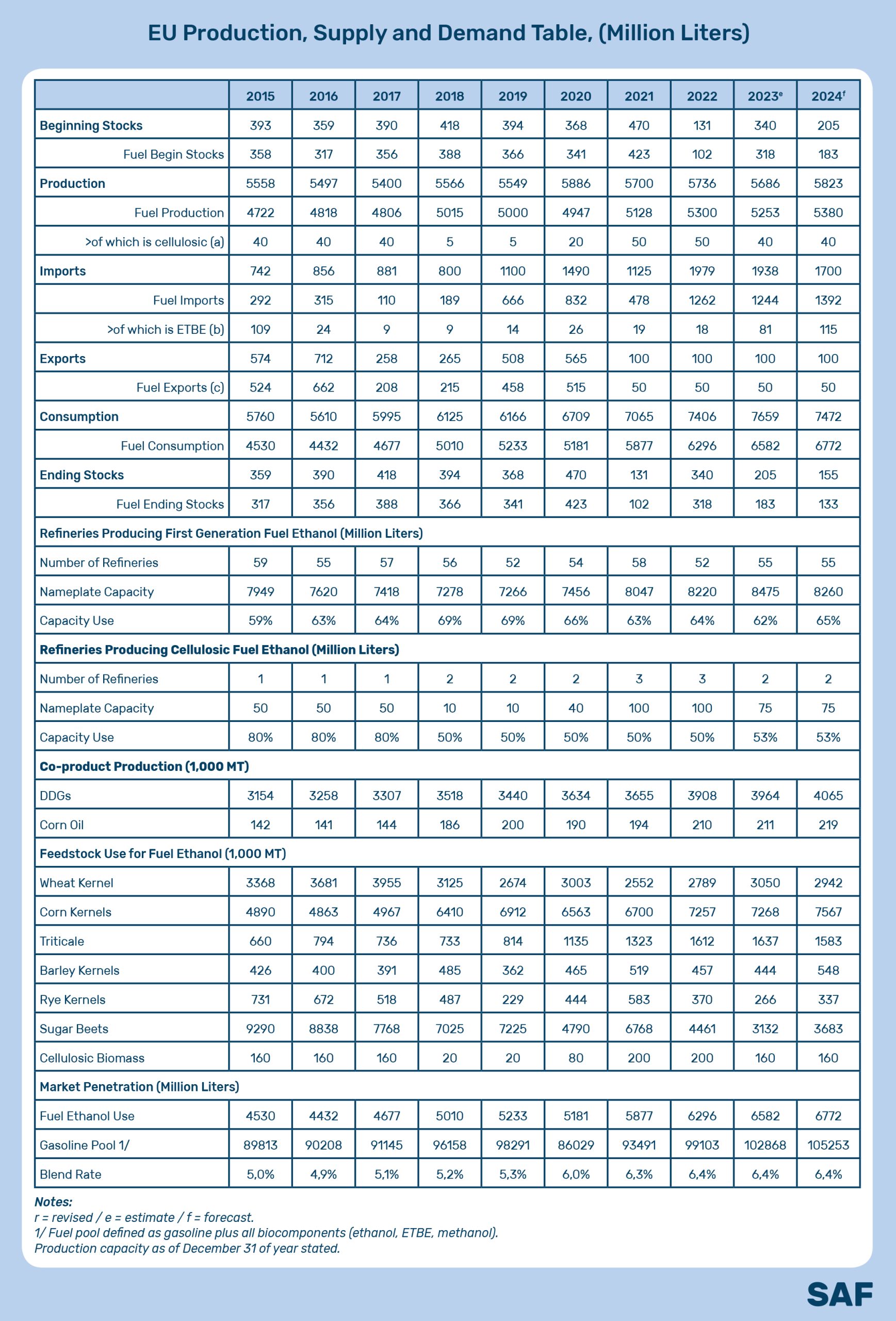

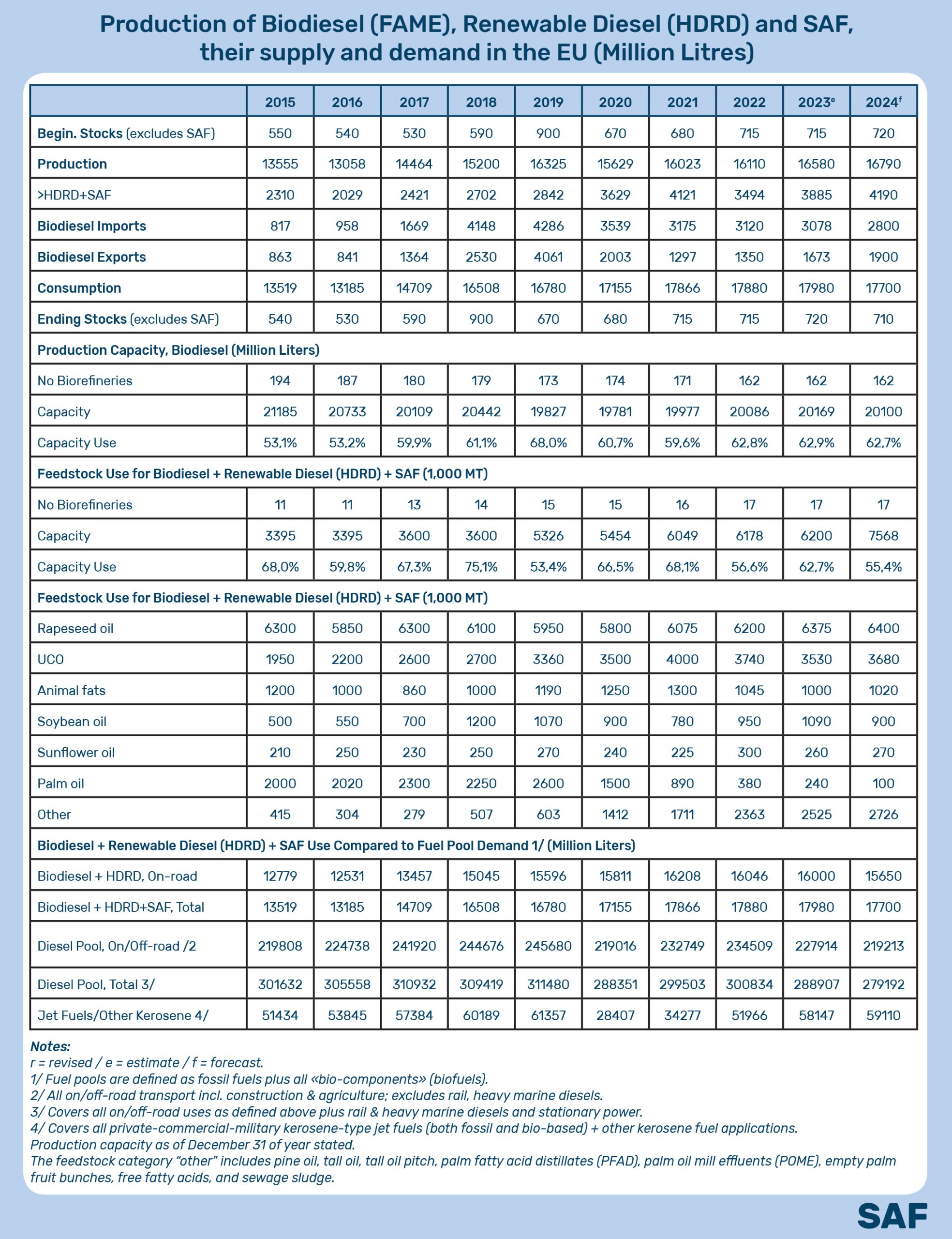

- In 2023, consumption of bioethanol and biomass-based diesel (BBD) are estimated to have increased by respectively 4.5 percent to 6.58 billion liters and 0.6 percent to 17.98 billion liters.

- For bioethanol, the expansion is mainly due to gasoline fuel pool growth, while growth for BBD is entirely due to increased blending.

- Whereas bioethanol use is forecast to further grow in 2024, BBD use is anticipated to fall based on reduced national greenhouse gas (GHG) reduction mandates and the use of BBD types with higher GHG reduction values.

- About a third of the domestically produced BBD is produced with waste oils and fats.

- Sustained growth in demand is forecast to support EU bioethanol imports this year. BBD imports are forecast to be restricted by new traceability and reporting rules.

Consider in more detail the trends in the development of biofuels for transport in the EU presented in this report.

EU policy on biofuels for transport

The European Commission (EC) has adopted a number of legislative proposals that will affect the use of biofuels in the road, air and maritime transport sectors in the medium and long term.

Source: UPM Biofuels

The EU Renewable Energy Directive (RED II) has been revised to align with the EU’s Green Deal goals of:

- a reduction of greenhouse gas (GHG) emissions of 55 percent by 2030.

- carbon neutrality by 2050.

- an overall renewableenergy target of at least 42.5 percent by 2030.

This revised REDII entered into force on November 20, 2023, with an 18-month period to transpose most of the Directive’s provisions into national law.

For transport, Member States can choose between:

- a target of reducing greenhouse gas (GHG) intensity by 14.5 percent up to 2030 (compared to 1990) ;

- ensuring a share of at least 29 percent of renewables in final energy consumption by 2030.

The Directive also sets out a binding target on non-crop based advanced biofuels (produced from raw materials specified in Part A of Annex IX) of 1 percent in 2025 and 5.5 percent in 2030, of which a share of at least 1 percentage point is from renewable fuels of non-biological origin in 2030. The EU capped cropbased biofuels at the level consumed in each Member State in 2020, with an additional 1 percent point allowed over present consumption up to an overall cap of 7 percent. Biofuels produced from feedstocks listed in Part B of Annex IX will be capped at 1.7% in 2030.

Member States can also set a lower limit for conventional biofuels than prescribed in the REDII. In May 2024, the EC adopted Delegated Directive (EU) 2024/1405 which adds new feedstock in Annex IX of the REDII. To qualify for counting towards the REDII targets, biofuels, bioliquids, and biomass consumed in the EU must comply with strict sustainability criteria provided in article 29 of the REDII. This article sets requirements on the minimum level of GHG savings, safeguarding against the conversion of highcarbon content lands and protection of biodiversity.RED II allows Member States to set additional sustainability criteria for biomass fuels.

The European Commission (EC) also adopted several legislative proposals that will affect the biofuels market in the medium to long term such as the Deforestation-free Supply Chain Regulation (EUDR). The EUDR targets products which are identified by the EC as the main drivers of deforestation including soy and palm derivatives. The requirements for economic operators will start on December 30, 2024.

Regulation 2023/851 sets a 100 percent reduction target for CO2 emissions for new passenger cars and new light commercial vehicles by 2035. Recently, the EU also adopted a Regulation revising CO2 emission standards for heavy-duty vehicles.

To promote the use of renewable and low-carbon fuels in the maritime and aviation transport sector, the EU adopted respectively Regulation (EU) 2023/1805 in September 2023, and Regulation 2023/2405 in October 2023.

Bioethanol

Bioethanol is produced by fermenting the carbohydrate components of plant materials. In the EU, the most used feedstocks are grains (e.g., corn, other coarse grains, and wheat kernels) and sugar beet. ‘Synthetic’ ethanol made from petroleum fuels is restricted to a very small market and is not included in this report. Ethanol used as transport fuel is referred to as bioethanol in this report.

The overall EU increase in bioethanol use of 4.5 percent in 2023 and 2.9 percent in 2024 based on:

- the further market introductions or continued expansion of E10 in many countries;

- rising availability of E85 in France;

- an overall increase in the gasoline fuel pool across the EU.

Increased sales of the higher blends in France are the main driver for total EU bioethanol consumption.

Currently, E10 is available in the following fifteen EU Member States: Austria, Belgium, Bulgaria, Denmark, Estonia, Finland, France, Germany, Hungary, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Romania, Slovakia, and Sweden. In France, consumption of E85 is supported by an increase in the number of flex-fuel cars. Superethanol-E85 is a fuel composed of 65 to 85 percent of bioethanol. Other countries where significant growth of bioethanol use is anticipated during 2023 – 2024 are Germany, Poland, Ireland, Austria, Spain, Belgium, and the Netherlands. Currently, Germany has the largest deficit of all. . For 2024, bioethanol consumption in transport is expected to increase only marginally despite some growth in the gasoline fuel pool. The increase in the GHG reduction mandate from 8 to 9.4 percent is leading to a higher share of electric vehicles.

In the EU, to reach the estimated 2024 production of 5.38 billion liters of bioethanol, the required cereals volume that will be needed is estimated at 12.9 MMT, an increase of about 233,000 MT compared to 2023. This is roughly 4.7 percent of total EU cereal production. Co-products from the bioethanol production process are DDG, wheat gluten, and yeast concentrates. In 2024, the maximum theoretical production level (calculated, using the conversion factors listed at the end of this report) of co-products is forecast to reach 4.0 MMT, an increase of roughly 73,000 MT from 2023. This accounts for 2.5 percent of total EU feed grain consumption. The volume of sugar beets to produce bioethanol is estimated at 3.1 MMT in 2023, and 3.7 MMT in 2024. This is roughly 3.3 percent of total EU sugar beet production.

Biobased Diesel

Bio-based diesel (BBD) includes biodiesel (fatty acid methyl esters, aka FAME) and renewable diesel. Renewable diesel, a full drop-in fuel replacement for fossil diesel, can be produced thru various feedstock-technology platform pathways, but the renewable diesel commercialized at scale today is hydrogenation-derived renewable diesel (aka HDRD). HVO (hydrotreated vegetable oil) is an older yet still frequently used term for HDRD. HDRD plants are typically designed to also produce sustainable aviation fuel (SAF). Due to the lack of readily available and accurate supply/demand data on SAF, this report includes SAF (volumes remain very small) in HDRD statistics and therefore BBD statistics as well.

The EU is the world’s largest BBD market for both production and consumption.

BBD consumption is driven almost exclusively by Member State blending and GHG reduction mandates and, to a lesser extent, by tax incentives. In 2020, a six percent GHG reduction mandate became applicable for all fuel suppliers in the EU (see Policy and Programs chapter). This favors the use of FAME with high GHG reduction values and HDRD, and especially the latter in countries already close to the seven percent volumetric blending limit for FAME (stipulated in the FQD).

BBD production is forecast to increase by 1.3 percent to 16.8 billion liters in 2024, largely driven by strong demand from export markets such as the United States and United Kingdom. However, this masks different developments for FAME and HDRD. HDRD production is expected to grow by 7.9 percent powered by increases in Sweden and Italy, as capacity increases in both countries. In contrast, EU-wide FAME production is forecast to marginally decline by 0.8 percent.

The structure of the EU biodiesel sector is quite diverse. Plant sizes range from an annual capacity of 2.3 million liters owned by a group of farmers to 680 million liters owned by a large multi-national company. FAME production facilities exist in every EU Member State, except for Finland, Luxembourg, Croatia, and Malta. In contrast, HDRD production occurs in only seven countries (Netherlands, Italy, France, Finland, Sweden, Spain and Portugal), plant size is uniformly larger scale, and the plants are owned and operated by oil majors.

HDRD and FAME facilities throughout the EU are operating below capacity and some FAME plants are temporarily shut down because of the competition from competitively priced imports, especially from China.

Advanced Biofuels

The EU’s Renewable Energy Directive (RED), extended under REDII, establishes an overall policy for the production and promotion of energy using “advanced” biofuels in the EU. Lower-carbon emission biofuels are replacing higher-carbon emission fossil fuels and biofuels (based on full life-cycle analysis) in the transportation. EU and national Member State policy is structured to limit further expansion of fossil fuels and incentivize expanded use of “advanced” biofuels.

Hydrogenation-derived renewable diesel is a drop-in fuel that can fully replace fossil diesel, and, with some modification in the production process at the plant, some level of sustainable aviation fuel (SAF) can be substituted for HDRD. All HDRD and SAF are treated as an advanced biofuel in this report but would only be considered “advanced” under EU policy when made with qualifying feedstocks including waste-stream feedstocks.

In 2023, HDRD (including a small volume SAF) production increased eleven percent to 3.89 billion liters based on increased production in Italy, the Netherlands, Finland, and Sweden. In 2024, HDRD production is forecast to increase by eight percent to 4.19 billion liters based on anticipated expansion of production in Sweden and Italy. The forecast production expansion will cause an increase in the demand of feedstocks, in particular the feedstocks listed in Part A and B of Annex IX of the RED ІІ. Food and feed are not permitted in SAF used to comply with targets. Комерціалізація целюлозного етанолу значно відстала від розвитку HDRD і не прогресує. The commercialization of cellulosic ethanol has lagged far behind the development of HDRD and is essentially not progressing. The main factors that prevent operators from investing in cellulosic ethanol are:

- high plant construction costs and operational challenges,

- insufficient regulatory support (financial incentives),

- the challenges of delivering large volumes of bulky, low energy content feedstock.

The 2023 EU capacity for cellulosic ethanol production is estimated at 125 million liters in 2023.

This review for SAF Ukraine was prepared by Semen Drahniev, an expert at the Bioenergy Association of Ukraine.