The World Bioenergy Association has recently published its annual report ‘Global Bioenergy Statistics. 11th edition. 2024 р’. It focuses on the global development of energy production from biomass. The data are presented at different geographical levels – global, continental and regional, covering all bioenergy sectors – liquid biofuels, biogas, pellets, forestry, agriculture, waste, etc.

Below are some of the key findings from the 2024 report. The document can be downloaded here.

Total Energy Supply

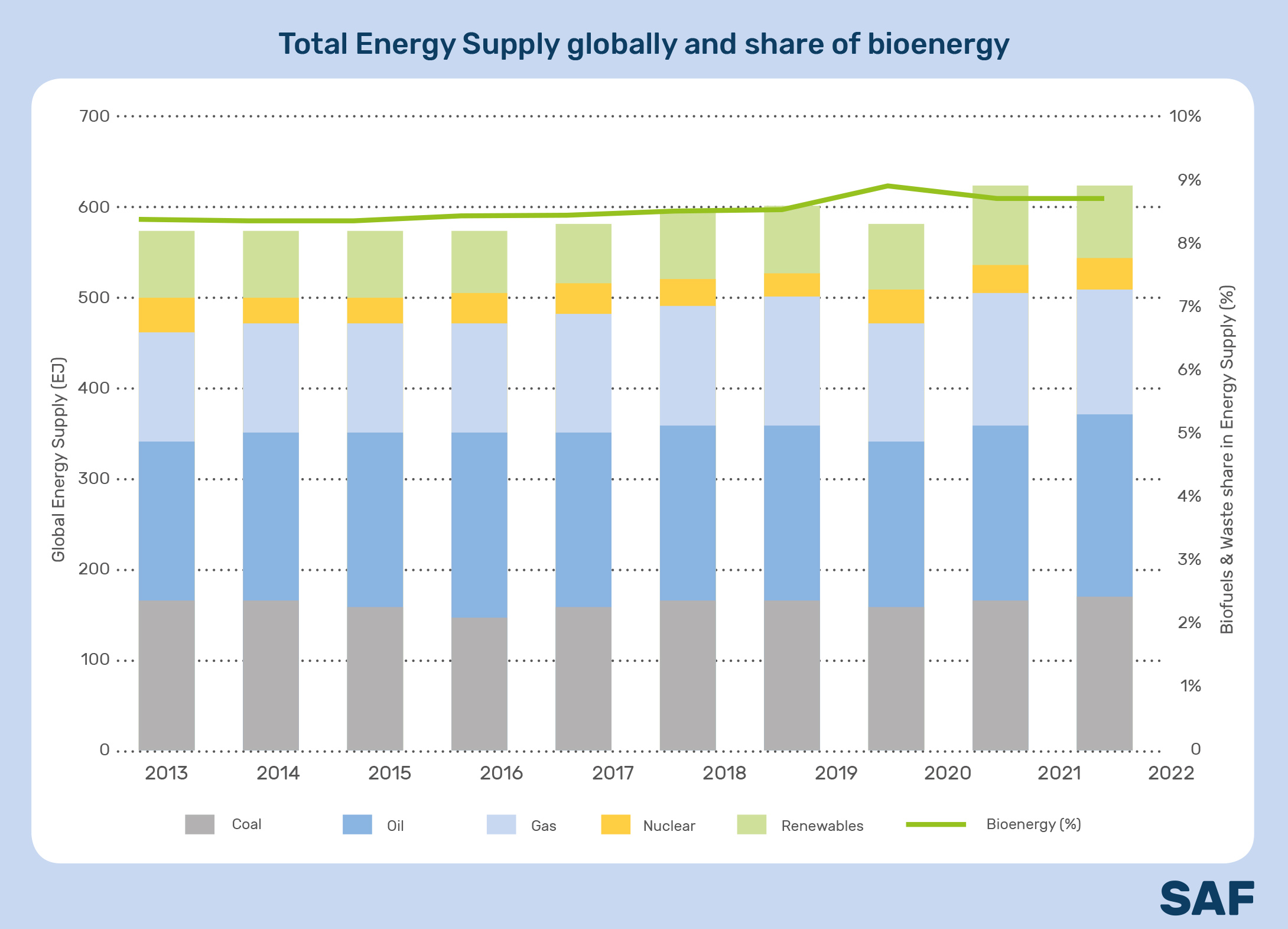

In 2022, the global energy supply reached 622 EJ, with fossil fuels continuing to dominate, providing 80% of the total supply. Renewable energy sources, however, continued their steady rise, supplying 89 EJ, which marked an almost 30% increase over the past decade. Bioenergy accounted for 9% of the total energy supply, maintaining a stable share.

Electricity

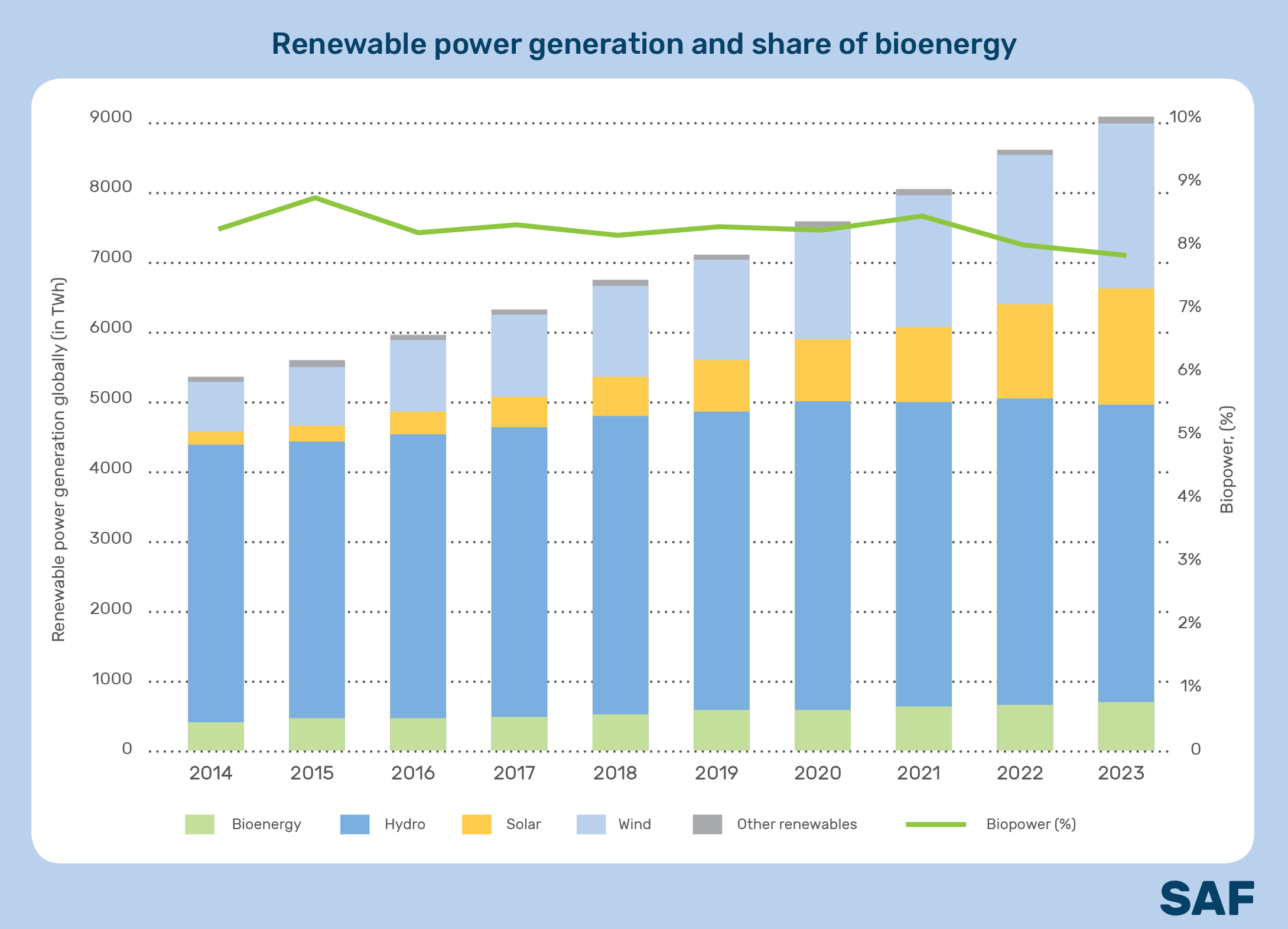

In 2023, global renewable electricity generation reached 8 931 TWh, with hydropower leading at 47% and wind at 26%. Bioenergy, the fourth largest source, contributed 697 TWh, maintaining an 8% share. While bioenergy has grown, its relative share has remained stable compared to wind and solar, which have expanded more rapidly in the past decade.

In 2023, Asia led global renewable electricity generation with 46% (4 087 TWh), followed by the Americas at 28% (2 505 TWh) and Europe at 22% (1942 TWh). For bioenergy, Asia was also the largest contributor with 51% (357 TWh). Europe followed with 28% (198 TWh), and the Americas provided 19% (133 TWh).

Heat

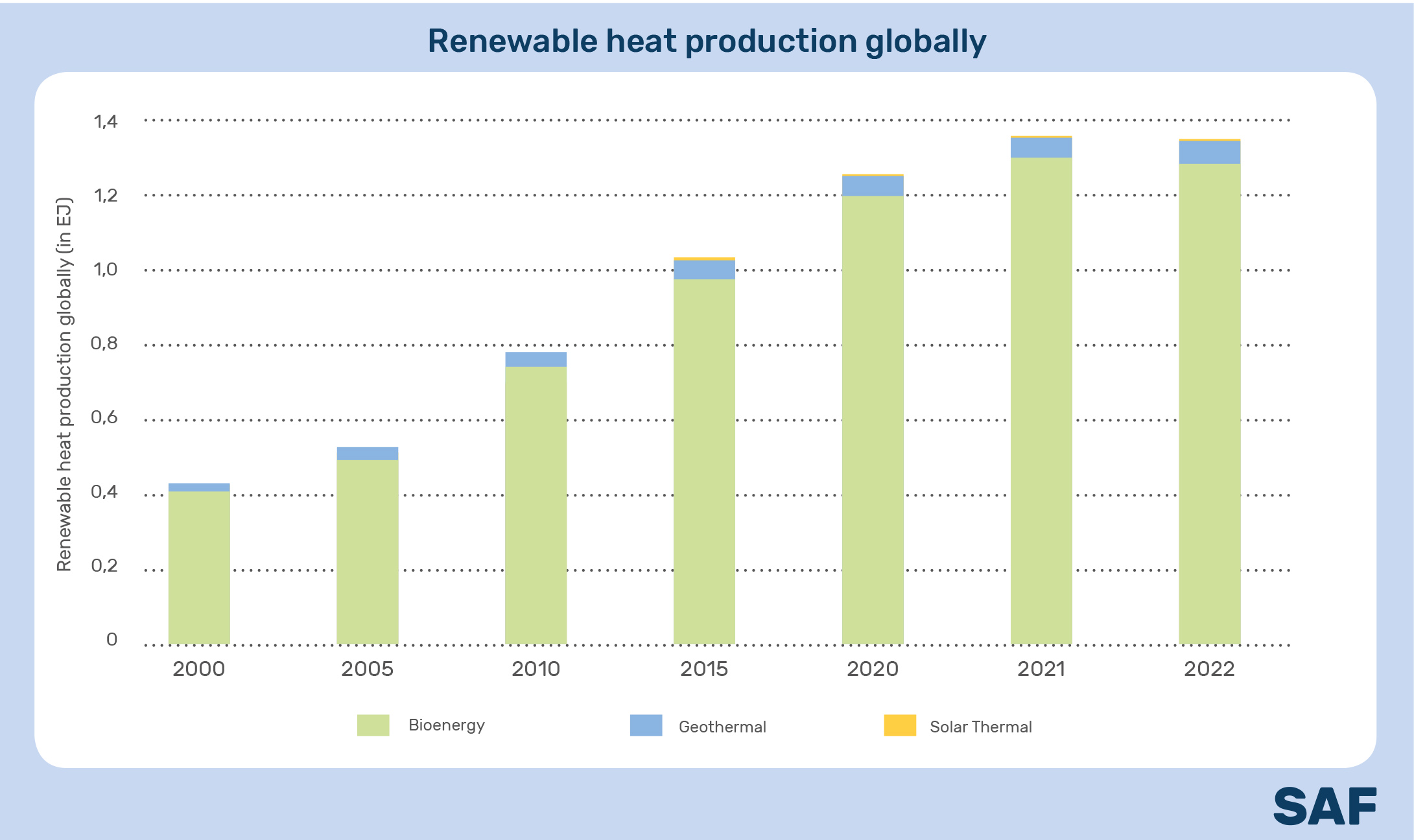

In 2022, 1.33 EJ of renewable heat was produced in both heat-only plants and combined heat and power plants. Biomass contributed to 96% of all renewable heat produced. Geothermal and solar thermal technologies had minor contributions. Regionally, Europe produces almost 80% of the global renewable heat, with bioenergy covering 95% of it.

Transport

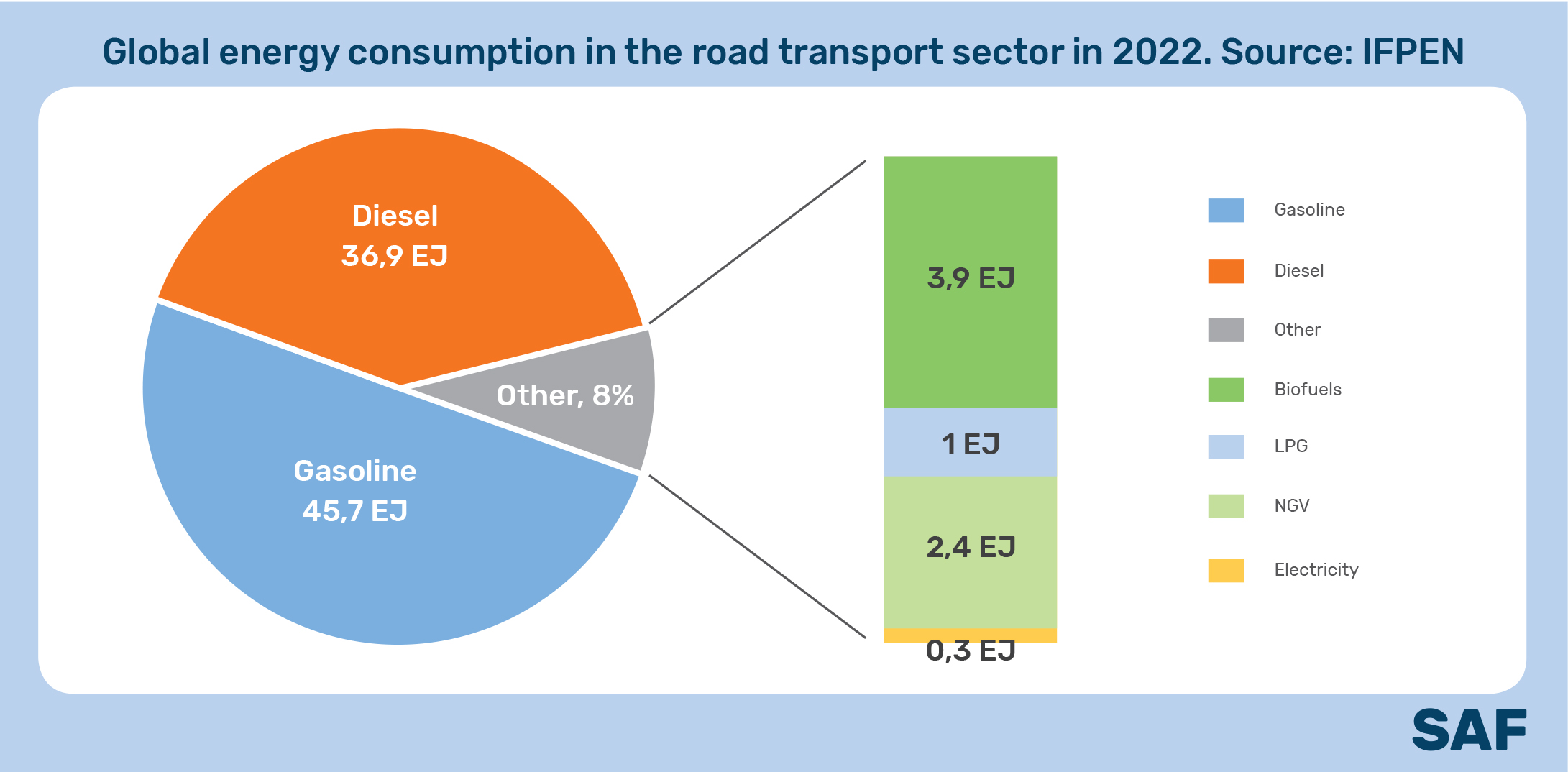

In 2022, energy consumption in the road transport sector reached around 90.6 EJ, a 3.4% increase from the previous year, returning to pre-pandemic levels – with fossil fuels still heavily dominated. Biofuels were the largest renewable source, contributing 3.94 EJ, which is 93% of all renewable alternatives and 4.3% of total transport energy in 20221. After a decline during the pandemic, biofuel use rebounded by 3.2% from 2021 to 2022, matching levels seen in 2019. Renewable electricity contributed 0.3% of total transport energy use in 2022. Biofuel mandates remained a critical tool for promoting renewable energy in transport, with 64 countries having mandates in place in 2023.

In 2022, the EU used 0.72 EJ of biofuels for transport, with France, Germany, and Italy leading consumption. Additionally, 25.9 TWh of renewable electricity powered the transport sector. Together, these renewable sources accounted for nearly 10% of the total energy used in EU transport that year.

The United States and Brazil are key players in renewable energy for transport. In 2023, 6% of the energy used in U.S. transport came from renewable sources, with biofuels making up the entire share. In Brazil, renewable energy made up 22.5% of transport energy consumption, primarily driven by ethanol and biodiesel in the same period.

Biomass Supply

In 2021, the domestic supply of biomass reached almost 54 EJ globally. 85% of the domestic supply was from solid biomass sources including wood chips, pellets, and traditional biomass. Liquid biofuels accounted for 7%, municipal and industrial waste sectors accounted for 2 – 3% followed by biogas at 2%.

Woodfuel

In 2022, more than 1.9 billion m3 of wood fuel was produced globally. Africa and Asia led the global production with shares of 37% and 35% respectively. Americas with 18%, concentrated mainly in South America; and Europe followed with 9%.

Wood Charcoal

In 2022, global wood charcoal production surpassed 57 million tonnes, with Africa emerging as the dominant producer, contributing 65% of the total output. Ethiopia and Nigeria are the leading producers within the region.

Wood Pellets

In 2022, global wood pellet production reached nearly 48 million tons, with Europe leading the production by contributing about 25 million tons, or 52% of the total. Germany remained the top producer in Europe, responsible for nearly 20% of the region’s output.

Agricultural Crops

Agricultural residues play a crucial role in bioenergy production, providing essential feedstocks for various bioenergy applications. As the demand for renewable energy grows, agro residues are increasingly recognized for their potential to contribute to climate and energy goals.

In recent years, the production of major energy crops has been crucial in meeting bioenergy needs. For instance, sugar cane remains a key feedstock for ethanol production, while crops like maize and soybeans are important for biofuel production and other agricultural residues

for biomass pellet production

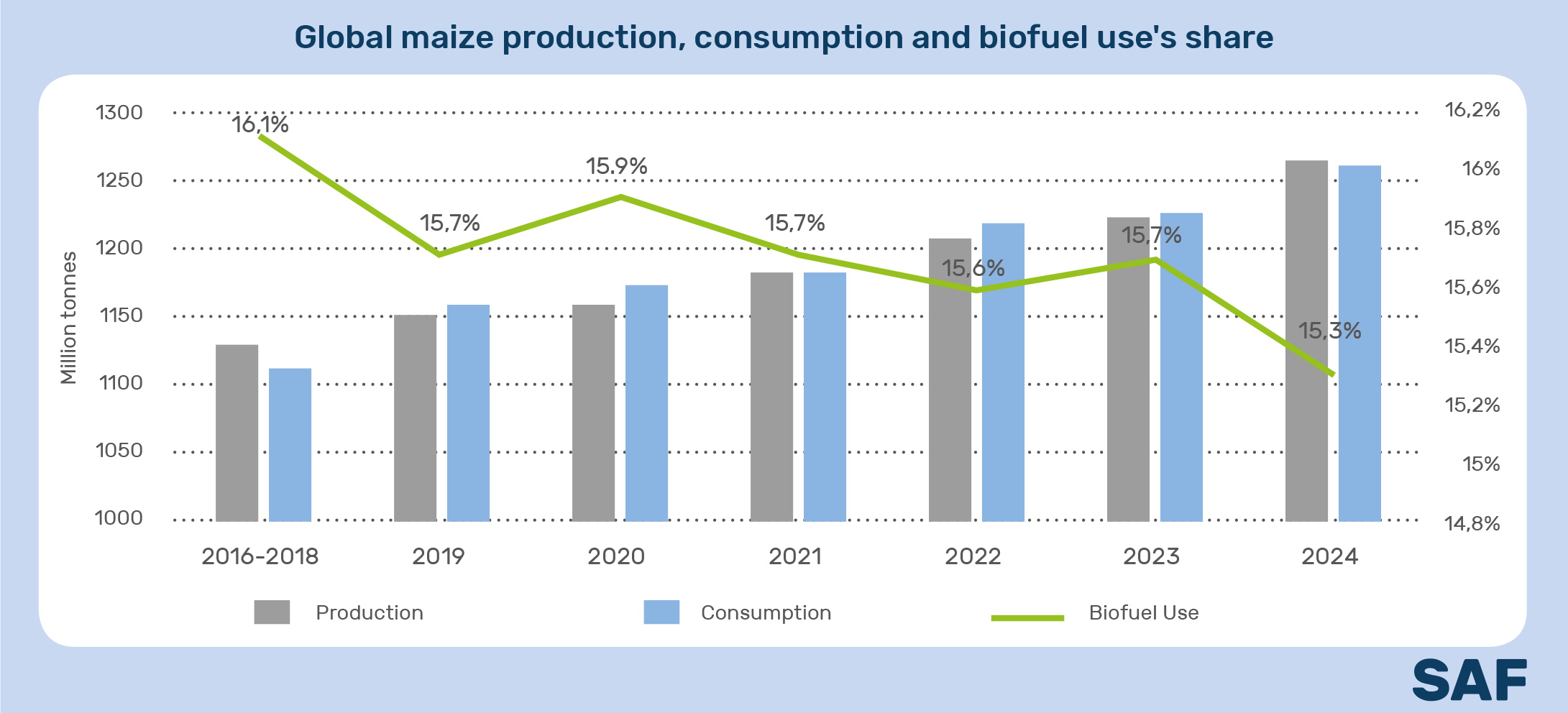

Maize

In major maize-producing countries such as the United States and China, maize is the primary feedstock for ethanol production. Similarly, in the European Union, corn kernels are the main feedstock for ethanol. Over recent years, both maize production and consumption have seen notable increases. Despite this growth, the yield has remained stable, and there has been only a modest expansion in the harvested area. This is a positive trend, as it indicates that the rising demand for maize, driven by both food and fuel needs, has been met without requiring significant increases in agricultural land

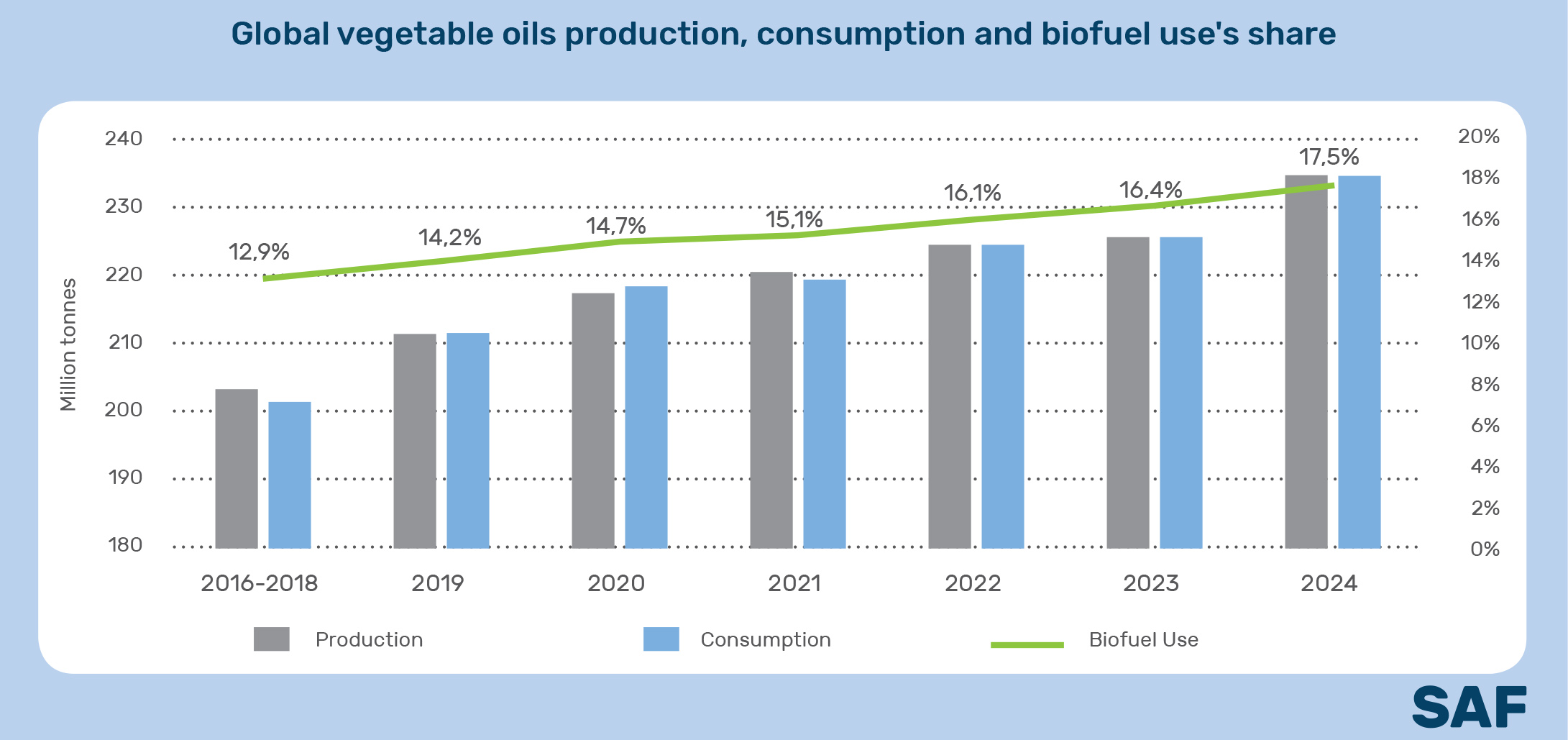

Vegetable Oils

Over recent years, the use of vegetable oils for biofuels has increased significantly, rising by nearly 60% from the average values observed between 2016 and 2018.

Under the Renewable Energy Directive (RED) III, aiming to enhance sustainability along the entire supply chain, the consumption of palm oil for biofuel production is expected to decline. However, this directive will likely lead to a rise in biofuel production from used cooking

oils. In Indonesia, the major global producer of palm oil, the introduction of B35 and B40 biodiesel mandates will drive up the demand for palm oil, which remains the primary feedstock for biodiesel in the country

Waste to Energy

In 2021, the domestic supply of energy from municipal and industrial waste was 2.7 EJ with 56% from municipal waste and the remaining from industrial waste.

Bioenergy

BioPower

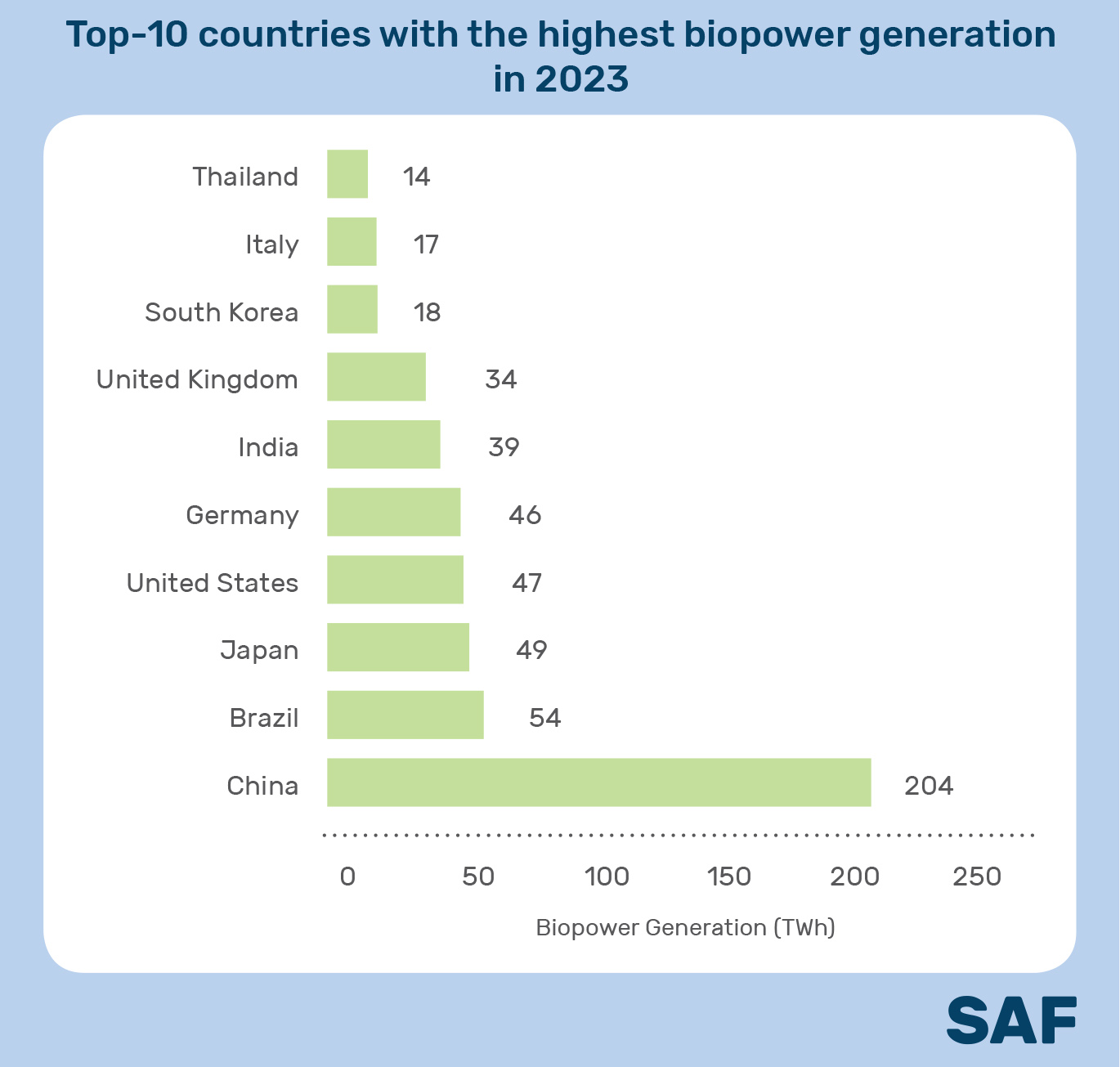

Biopower generation has grown steadily from 439 TWh in 2014 to 697 TWh in 2023 – with Asia leading this growth. Within the decade, Asia’s share rose from 28% to 51% of global biopower, reaching 357 TWh, surpassing Europe. The Americas saw a slight decline from 146 TWh to 133 TWh, while Africa & Oceania remained relatively stable, averaging around 7-8 TWh.

In 2023, China generated more than a quarter of the world’s biopower at 204 TWh. Brazil saw a record generation of 54TWh, with 637 biomass-powered projects across the country. The third largest contributor was Japan, recording the highest increase rate of 18% from 2022 values, contributing with 49TWh. In 2023, Bioenergy largely contributed to countries’ electricity generation. For example, in Denmark, bioenergy made up more than 20% of total electricity generation. In Finland and the United Kingdom, bioenergy accounted for 14% and 12% of their electricity generation, respectively.

BioHeat

In 2022, 1.28 EJ of heat was produced from biomass-based sources – 51% from solid biomass sources and 28% from municipal solid waste. In 2021, 0.64 EJ of biomass was used in thermal plants, of which 0.38 EJ was solid biomass.

In the EU, 0.51 EJ of heat energy was produced from solid biofuels, of which half was in Sweden, Finland and Denmark.

BioFuels

The global production of liquid biofuels has increased within the last decade, with global output reaching approximately 160 billion liters in 2022. The highest recorded increase has been in the production of renewable diesel, which has increased from 2.6 in 2013 to more than 13 billion liters in 2022, more than 5 times higher. Additionally, biodiesel production increased almost 60% from 2013 values. Since 2019, the production of biojet has increased over 5 times higher.

Bioethanol

In 2023, ethanol remained the leading liquid biofuel globally, with production reaching 116 billion liters, accounting for roughly 70% of the global production of liquid biofuels.

The United States and Brazil dominated the market, together accounting for approximately 80% of global production. The U.S. produced 59 billion liters, while Brazil contributed 35 billion liters. India surpassed the European Union to become the third-largest producer of fuel ethanol, with 6.4 billion liters in 2023, reflecting a 28% increase from the previous year. This growth is largely attributed to the country’s Ethanol Blended Petrol Programme (EBP), which has driven demand and achieved a 12% blending rate in 2023, with a target of E20 by 2025. The EU followed with an output of 5.3 billion liters, with France leading the region, accounting for 20% of European production.

Biodiesel

In 2023, global production of fatty acid methyl ester (FAME) biodiesel approached 50 billion liters. Indonesia led the production with nearly 14 billion liters, primarily utilizing palm oil as its main feedstock. The European Union (EU) followed with 13 billion liters, produced mainly from rapeseed oil and used cooking oil, with Germany, Spain, and France contributing more than half of the EU’s total output. Brazil generated almost 8 billion liters of biodiesel, using soybeans as the primary feedstock. The United States and China were next in line, producing 6 billion liters and 3 billion liters, respectively

Renewable Diesel

Hydrotreated vegetable oil (HVO), also known as renewable diesel, emerged as a significant bio-based diesel option, compatible with existing diesel engines either in pure form or as a blend. In 2023, the United States led global production with approximately 11 billion liters, marking a dramatic increase from the previous year, almost doubling it. The European Union followed with nearly 4 billion liters of HVO production. China, a new player in the HVO market, produced 1.4 billion litres in 2023.

Biogases

Biogas is produced by anaerobic fermentation of different forms of organic matter and is composed mainly of methane (CH4) and carbon dioxide (CO2). In 2021, almost 40 billion m3 of biogas was produced globally with an equivalent energy content of 1.5 EJ.

Socio-economic Updates

Job Creation

The bioenergy sector continues to be a significant source of employment globally, driven by increased blending targets in liquid and gaseous biofuels and the adoption of biomass in energy production

In 2023, the global bioenergy sector generated approximately 3.9 million jobs. Of these, liquid biofuels accounted for the largest share, with more than 2.8 million jobs, representing more than 70% of the total bioenergy workforce. The solid biofuels subsector employed approximately 765, thousand people for electricity and heat production. Biogas production employed 316 thousand people.

In Europe, the bioenergy sector employed 530 700 people in 2022. The solid biofuels subsector was the largest employer, accounting for 63% of these jobs, followed by liquid biofuels at 28% and biogas at 9%.

Investments

Bioenergy is currently a market valued at approximately USD 44 billion, and the sector is poised for significant growth20. McKinsey estimates that over USD 150 billion in investments have already been planned for sustainable fuel production, encompassing more than 200 projects related to hydrotreated fuels (HVO/HEFA), alcohol-to-jet, and biomethanol, among others. In 2022, global investment in bioenergy reached nearly USD 9 billion, with 66% directed towards biofuels and the remaining portion toward solid biomass. Investment trends over the past decade have shown considerable fluctuation. However, the recent surge in biofuel investments, driven by evolving policies and increasing global demand, highlights the sector’s growing importance and potential.

The Global Bioenergy Statistics 2023 report can be found at the link.

This review for SAF Ukraine was prepared by Semen Drahniev, an expert at the Bioenergy Association of Ukraine, a full member of the World Bioenergy Association.