On September 9, 2024, the European Biogas Association held a webinar titled “Mapping e-methane plants and technologies: The role of e-methane in the total energy mix”. We are sharing the key takeaways from the experts.

E-methane: the golden molecule?

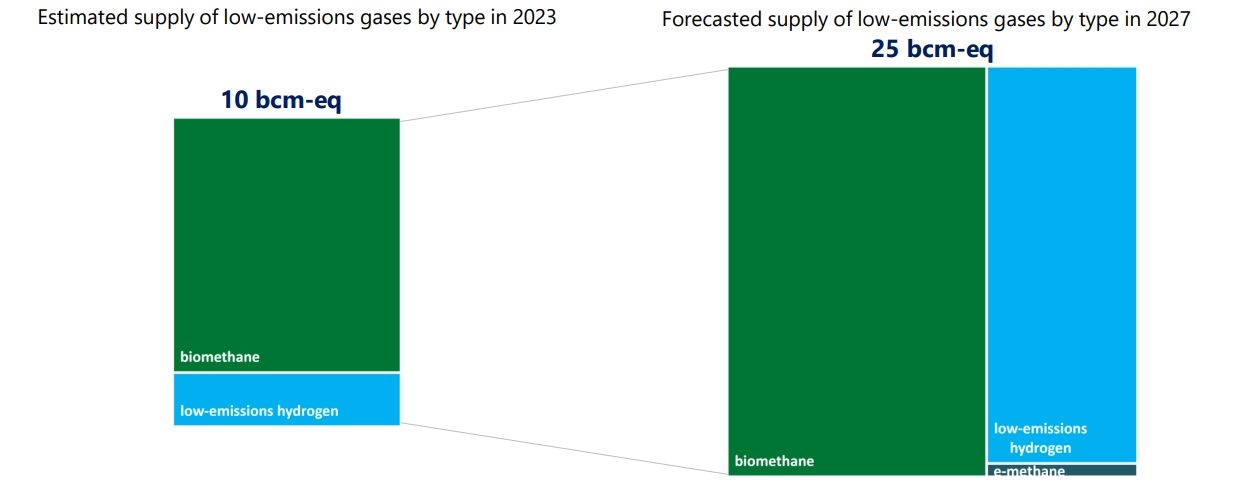

According to the key pillars of the IEA (International Energy Agency) Low-emissions Gases Work Programme, Low-emissions gases are set for a rapid growth. Estimated supply of low-emissions gases by type in 2023 10 bcm-eq (biomethane + low-emissions hydrogen)

Forecasted supply of low-emissions gases by type in 2027 25 bcm-eq (biomethane + low-emissions hydrogen + e-methane).

Low-emissions gases are expected to more than double in the medium-term. Nevertheless, further efforts are required to reach the ambitious targets set by governments.

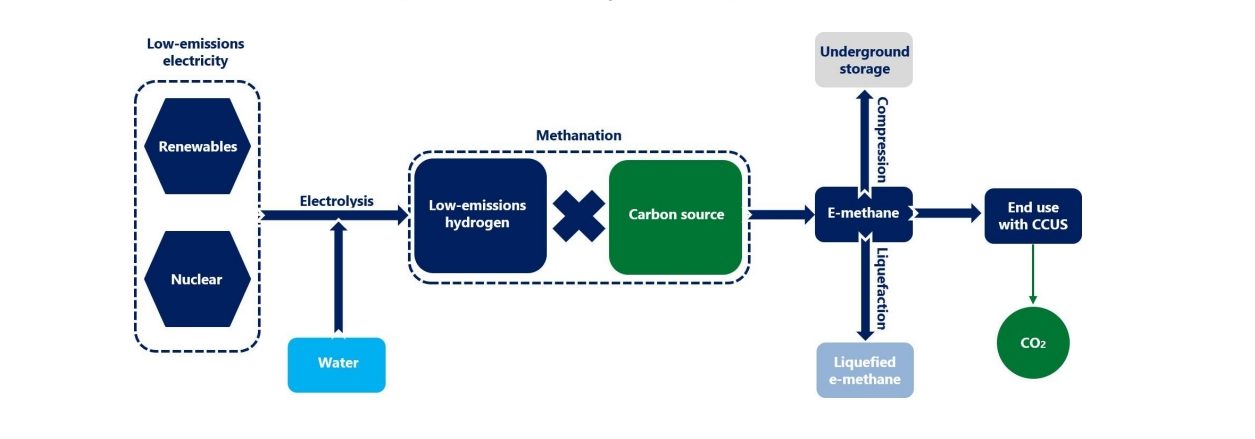

As for e-methane, it is produced through a two-step process. Low-emission electricity is first converted to hydrogen by electrolysis and the resulting is converted via electrolysis into hydrogen, which is then reacted with a carbon source to obtain e-methane. More details can be found in the diagram below.

At present, e-methane is facing relatively high production costs. Current e-methane production costs are in the range of $50-200/mm btu, which would be four to fifteen times higher than current Asian spot LNG prices. Despite this, e-methane can play a crucial role in the coupling of future hydrogen and methane networks, facilitate trading and provide a solution to large-scale, seasonal storage in porous formations.

Demand creation will be crucial: the example of Japan. Japan set a target for e-methane to comprise 1% of the gas supply in existing networks by 2030, increasing to 90% by 2050.

International partnerships drive e-methane projects potentially delivering over 1 billion cubic meters by 2030. However, their development is pending on project partners successfully reaching final investment decisions in the coming years.

Therefore:

- Low-emissions gases are expected to more than double in the medium-term.

- E-methane could play a significant role in decarbonising existing gas networks without the need for retrofitting.

- Both investment costs and operational expenses are relatively high..

- E-methane can play a crucial role in the system integration of low-emissions gases.

- Demand creation will be critical to support final investment decisions in e-methane.

Mapping e-methane plants and technologies

E-methane production refers to a group of technologies that enables the conversion of electricity into the methane molecule, using CO2 and H2 as raw material.

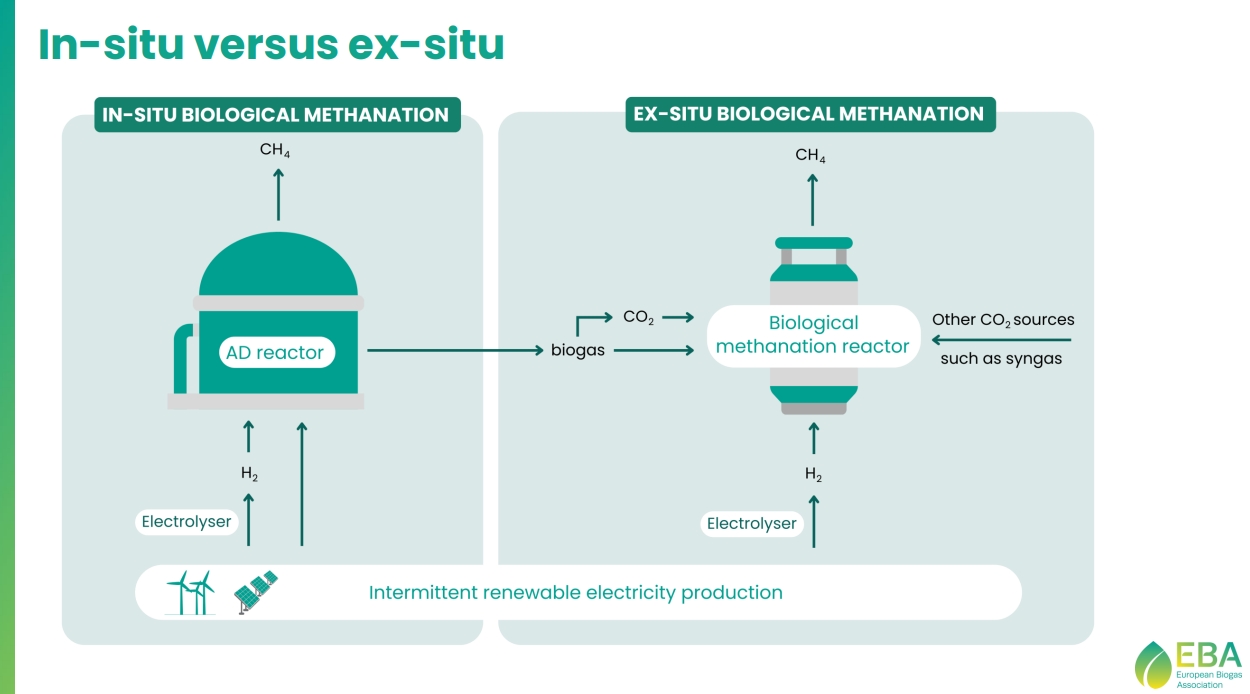

There are two types of e-methane production technologies: biological methanation and chemical/catalytic methanation. Biological methanation, in turn, can be in-situ and ex-situ.

Advantages of Methanation Technology:

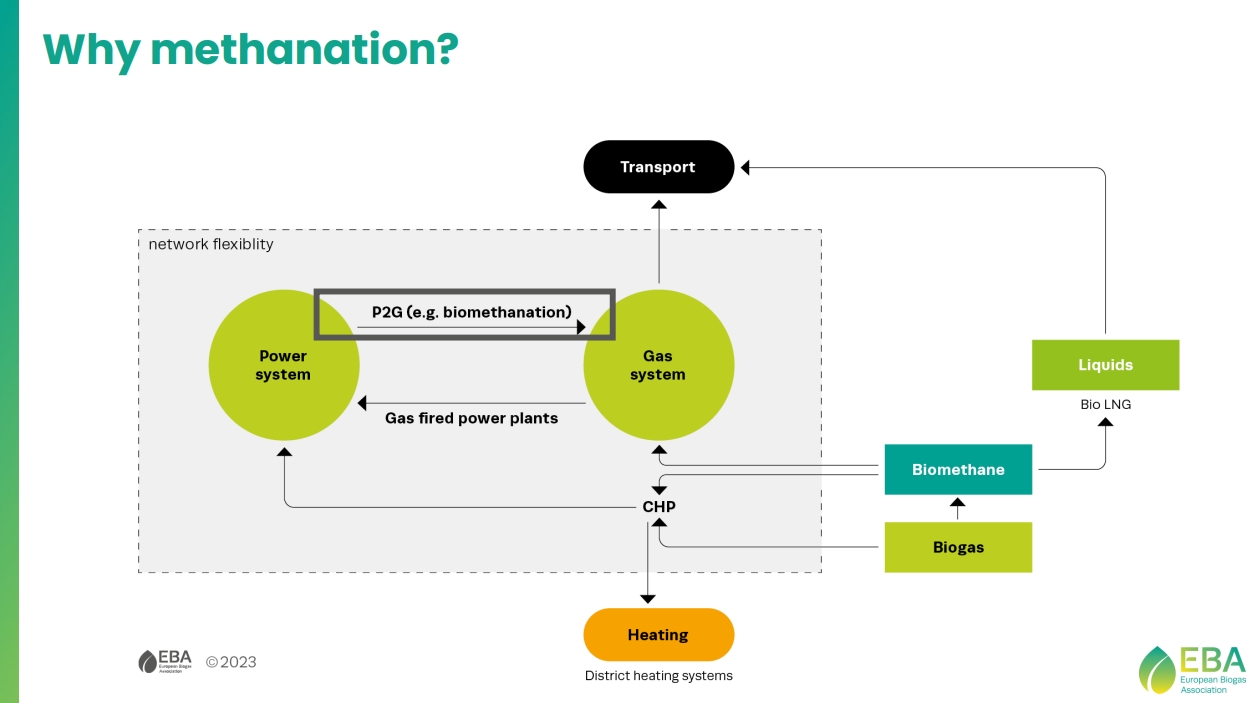

- Integration of the energy system: stronger connection between the electricity and gas grid;

- Seasonal energy storage: excess renewable electricity is stored in the gas grid in the form of e-methane;

- Complementary roles for hydrogen and biomethane.

Categorisation of plants based on source of electricity and CO2:

- Fully renewable plants: biogenic CO2 + green hydrogen/electricity;

- Partially renewable plants: industrial CO2 + green hydrogen/electricity;

- Partially renewable plants: biogenic CO2 + non-renewable hydrogen/electricity.

Fully renewable plants represent 98% of total production capacity.

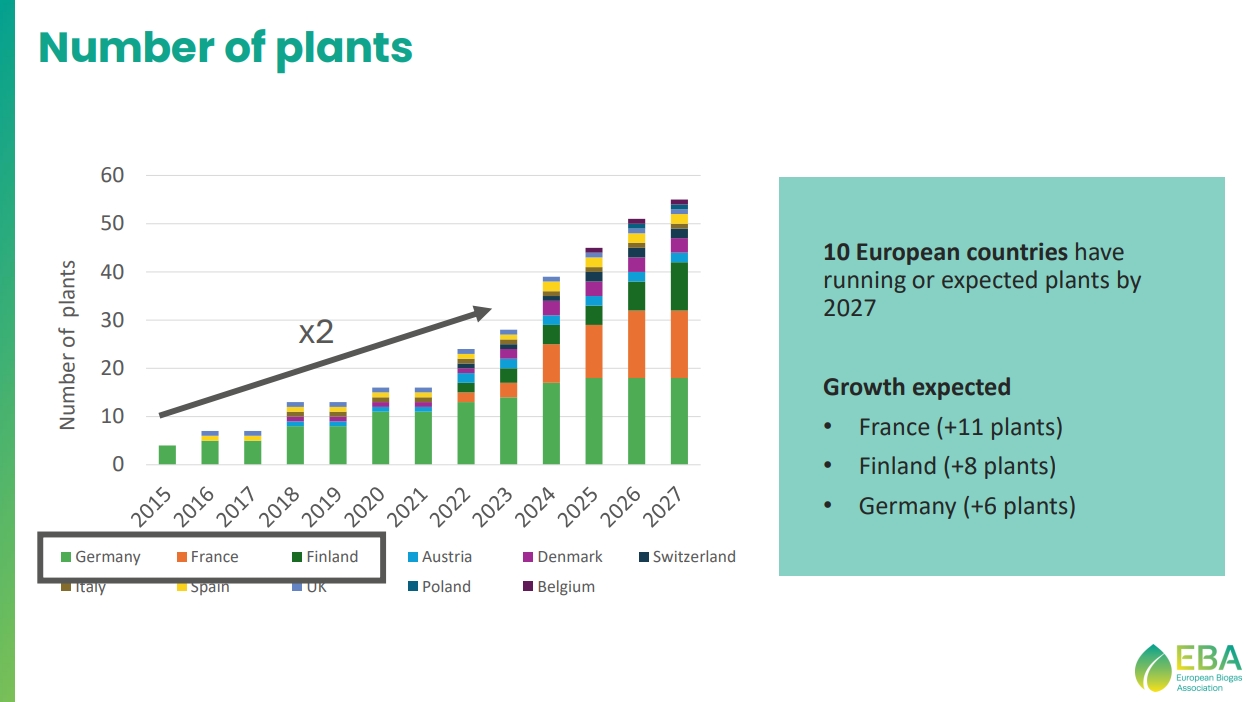

As shown in the chart, e-methane production in Europe is growing rapidly. Currently, there are 35 plants in operation, 33 of which are fully renewable. Germany leads with 14 facilities. Additionally, Europe plans or is in the process of building 20 new e-methane production plants, indicating further sector growth.

Production capacity shows even steeper growth. Biggest production capacities in 2023:

- Finland (282 GWh/year)

- Germany (68 GWh/year)

- Denmark (64 GWh/year)

Finland has big biogenic reservers, linked to district heating facilities, pulp and paper, waste-to-energy and AD (anaerobic digestion).

Economic considerations for the development of e-methane production technologies:

- Significant potential for existing biomethane plants: methane output can be increased by 40-60%;

- Promising in future power system scenarios dominated by intermittent renewables;

- Profitability will highly depend on hydrogen or power costs and the value of power grid stability;

- Different operating strategies: 1. Operate few hours with cheap electricity (high capex); 2. Operate for longer periods at somewhat higher prices (lower capex).

You can review the full presentation of the webinar at the following link.

The key points from the speakers were prepared for SAF Ukraine by Tetiana Suprun, an expert from the Ukrainian Bioenergy Association.